Understanding Insurance: A Friendly Guide to Navigating Policies and Coverage

Navigate insurance with ease using this helpful guide on policies and coverage.

Have you ever found yourself buried in insurance jargon and thought, "Why is this so complicated?" You're not alone! Many people feel overwhelmed when trying to understand their insurance policies. But fear not, we’re here to unravel the mysteries of insurance in a way that’s clear, friendly, and a tad bit comedic. Let’s dive in!

What Exactly is Insurance, Anyway?

Think of insurance as a safety net. It's there to catch you when life throws unexpected snafus your way. Whether it’s health, auto, or home insurance, the primary purpose is the same: to protect you and your wallet from unforeseen expenses. Imagine a rainy day fund, but managed by someone else.

Decoding the Different Types of Insurance

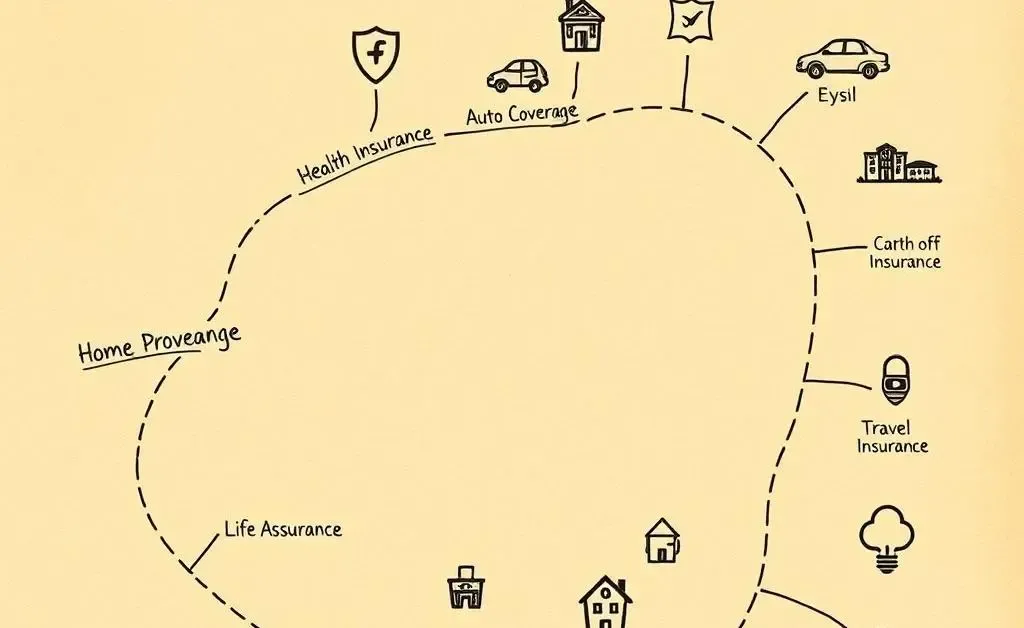

There’s a wide array of policies available, each with its own set of rules and benefits. Here's a quick look at some of the most common types:

- Health Insurance: Covers medical expenses and sometimes even routine checkups.

- Auto Insurance: Protects against the financial impact of car accidents and vehicle theft.

- Home Insurance: Provides coverage for your home in case of damage or loss.

- Life Insurance: Offers financial support to your loved ones in the event of your passing.

- Travel Insurance: Safeguards your trips against unexpected mishaps.

Each type comes with specific terms, which we'll explore in the sections below.

The Fine Print: Understanding Your Policy

Let's talk about that often overlooked section: the fine print. An anecdote here—a friend of mine once bought a health insurance policy without reading through all the details. A year later, they needed a procedure and were shocked to discover it wasn't covered. Always make sure to read and understand your policy thoroughly to avoid surprises.

Am I Covered?

Insurance coverage can sometimes feel like a choose-your-own-adventure book. You choose the policy, but you might not always know where you’ll end up. It's crucial to ask questions such as:

- What exactly does my policy cover?

- Are there any exclusions?

- What is the claims process like?

- How can I reach customer service during an emergency?

Once you have these answers, you are much better prepared when things go awry. It pays to be a little skeptical and highly inquisitive!

Bringing it All Together

Insurance doesn’t have to be a daunting topic. By understanding your options and asking the necessary questions, you can tailor it to suit your lifestyle and needs. Remember to review your policies annually and adjust coverage as needed to ensure you’re always adequately protected.

What has been your experience with insurance? Have you ever encountered a surprise due to unread fine print? Share your thoughts below, and let's start a conversation!