Understanding Lender Insights: A Guide to Smarter Loans

Explore key lender insights for smarter loans and make informed financial choices.

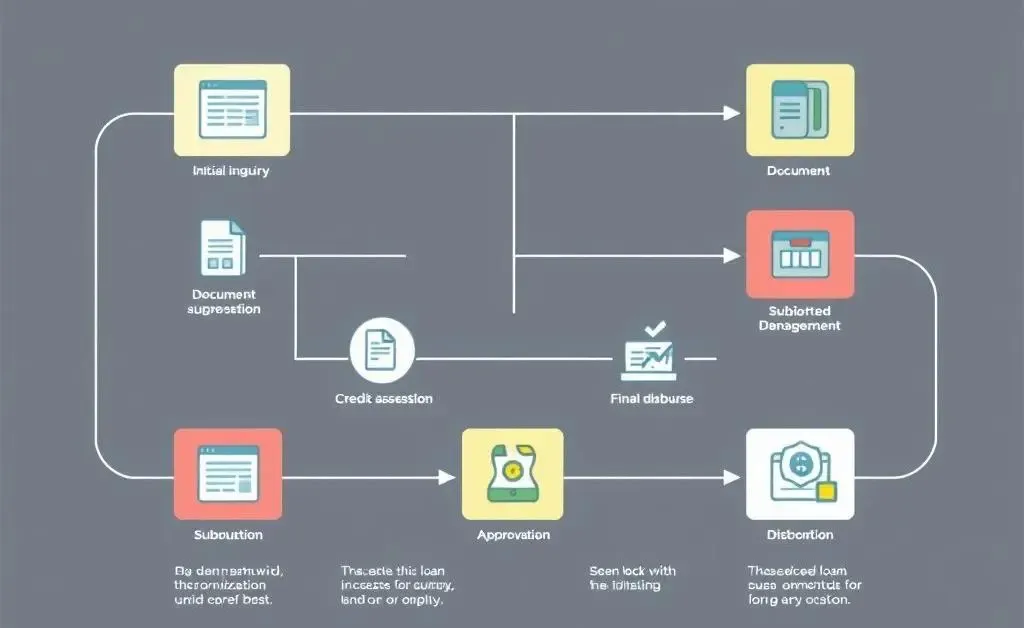

Have you ever felt overwhelmed by the loan process and wondered what magic happens behind the scenes? Understanding lender insights is your key to navigating the labyrinth of loans with confidence. Whether you're eyeing a mortgage or considering a personal loan, being informed can save you both money and stress.

What Are Lender Insights?

Simply put, lender insights provide a peek into how financial institutions assess loans. Knowing this can help you better present your case and improve your chances of favorable terms. These insights highlight what lenders consider, from credit scores to income stability.

Key Factors Lenders Assess

- Credit Score: Your credit score is like your financial GPA. It offers lenders a quick way to gauge financial responsibility.

- Income Stability: Regular income streams reassure lenders you'll make timely payments.

- Debt-to-Income Ratio: This ratio shows how much of your income goes to debt and if you can manage additional payments.

- Employment History: A steady job history can give lenders peace of mind about your earning consistency.

Why Lender Insights Matter

Arming yourself with lender insights can transform you from an anxious borrower into a savvy negotiator. Think of these insights as a toolkit to improve your borrowing power.

For instance, consider Jane, who last year was thrilled about buying her first home. Excited, she applied for a loan without giving much thought to her credit report. Unfortunately, her score had a pesky error that resulted in a higher interest rate. Armed with lender insights now, Jane knows better than to overlook such details.

How to Use Lender Insights to Your Advantage

Once you're familiar with what lenders look for, use this knowledge strategically:

Steps to Boost Your Loan Prospects

- Check your credit score regularly and fix any discrepancies.

- Ensure steady income and employment history before applying.

- Manage your debts by improving your debt-to-income ratio.

- Consult with financial advisors for personalized advice.

By proactively addressing these areas, you not only appear more appealing to lenders but also might secure a much better rate—one that fits snuggly with your financial goals.

What's Your Experience?

Understanding lender insights is a continuous journey. Have you ever encountered surprises during your loan application process? I'm curious to know how you managed. Your story might just be the insight someone else needs!