Understanding Life Insurance: A Beginner's Friendly Guide

Explore life insurance basics, types, and how to choose the right plan in this beginner-friendly guide.

Have you ever wondered how life insurance really works and if you actually need it? You're not alone. Navigating the world of life insurance can feel a bit like trying to read a map in a foreign language. But fear not, dear reader! In this guide, we'll break down the basics and make life insurance as straightforward as ordering your favorite coffee.

What is Life Insurance?

Think of life insurance as a safety net for your loved ones. It's a contract between you and an insurance company where you pay regular premiums, and in return, the company provides a lump sum to your beneficiaries when you're no longer around. It's essentially peace of mind wrapped in a policy.

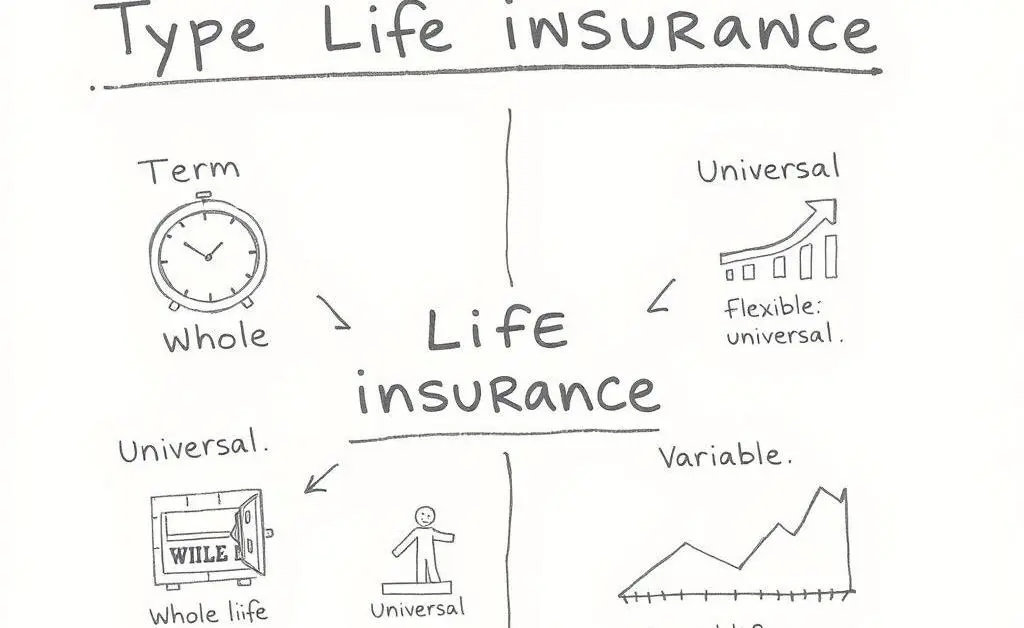

Types of Life Insurance

Before you dive in, it's important to know the different types:

- Term Life Insurance: This one is straightforward. It's temporary and covers you for a specific timeframe, like 10, 20, or 30 years. It's generally more affordable.

- Whole Life Insurance: Coverage that lasts your entire lifetime and includes a cash value component. Premiums are higher, but it can be seen as an investment.

- Universal Life Insurance: Offers flexibility with your premiums and coverages. It combines the benefits of term and whole life insurance.

Choosing the Right Plan

A fictional friend of mine, Emily, found herself overwhelmed with options. She had just started a family and wanted to make sure they were protected. Here's how Emily simplified her decision:

- She assessed her current financial situation and future needs.

- She considered how long her family would need support if something happened.

- She compared different policies and their costs without rushing into the first offer.

Should You Get Life Insurance?

If you have dependents or financial obligations that won't just go away, life insurance could be a smart move. It ensures that, in the face of unexpected events, your loved ones aren't left in financial distress.

Conclusion

Life insurance can seem daunting at first, but once you understand the basics, it becomes just another tool in your financial toolbox. Have you thought about what type of coverage best suits your situation? Maybe it's time to have that conversation.