Understanding Life Insurance: A Practical Guide to Protecting Your Future

Learn how to navigate life insurance options and secure peace of mind for your family's future.

Understanding Life Insurance: A Practical Guide to Protecting Your Future

Hey there! If you're like me, balancing financial security and peace of mind is a top priority. One of the great ways to do this is through life insurance, a tool often surrounded by questions and myths. Let's break it down together.

What is Life Insurance?

In essence, life insurance is a contract that protects your family financially if something happens to you. By paying regular installments known as premiums, you ensure that a sum of money is available for your beneficiaries when you're no longer around.

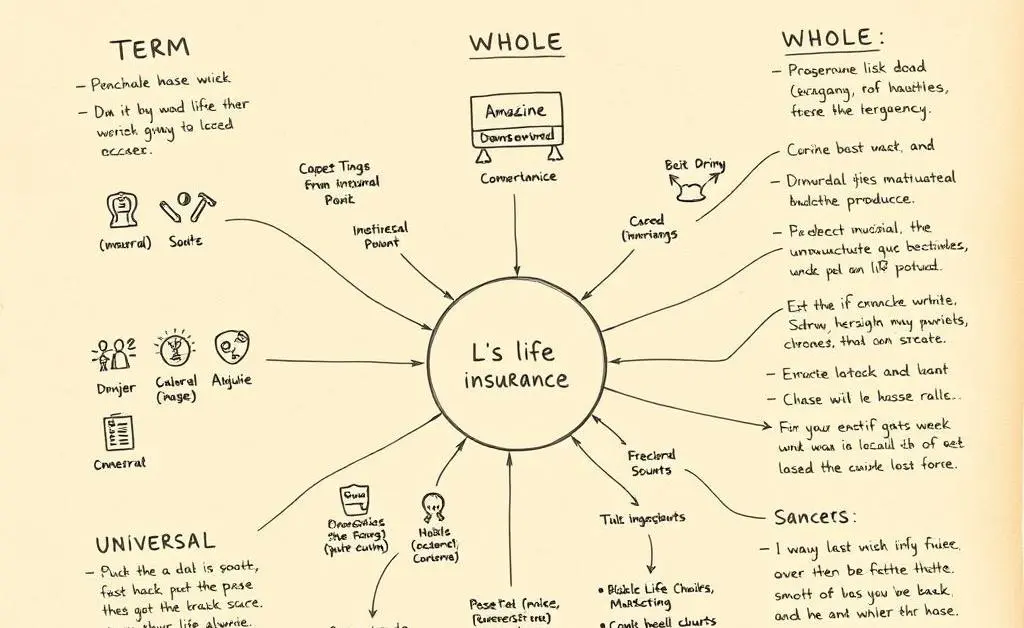

Types of Life Insurance

- Term Life Insurance: Covers you for a specific period. If you pass away during this term, your beneficiaries receive the payout. It's simple and usually the most affordable option.

- Whole Life Insurance: Provides lifelong coverage. It has a cash value component that grows over time, but at a higher premium compared to term insurance.

- Universal Life Insurance: Offers flexibility in adjusting premiums and death benefits along with a cash value element.

Why Consider Life Insurance?

Besides the obvious financial protection, life insurance gives your family time to grieve without financial stress. It can help cover funeral costs, pay off debts, or provide for your children’s future education expenses.

Pros and Cons of Life Insurance

Advantages

- Peace of mind for you and your loved ones

- Helps cover unexpected expenses

- Offers financial security during difficult times

Disadvantages

- Can be costly, especially if you're not careful about what you choose

- May not be necessary for everyone, depending on circumstances

Choosing the Right Policy

Finding the right policy comes down to understanding your needs and budget. Consider how much coverage you require, and take the time to compare details and premiums from different providers.

What to Look for in a Policy

- Policy terms and conditions

- Reputation and ratings of the insurance provider

- Flexibility and policy features that fit your needs

Final Thoughts

In the ever-changing world of financial planning, life insurance remains a crucial component for many. Whether you're securing your children’s financial future or simply seeking peace of mind, understanding life insurance helps you make informed decisions. So, how about you? What's your take on life insurance?