Understanding Mortgage Officer Salaries: What to Expect and How to Navigate

Learn about mortgage officer salaries, influencing factors, and career insights.

So you're thinking about becoming a mortgage officer, huh? It's a fascinating career with a lot of potential, but it also comes with its share of questions—especially around salary expectations. Today, we're diving into what you can expect in terms of pay as a mortgage officer, the factors that might influence your earnings, and some career insights to help you navigate this path.

What Determines a Mortgage Officer's Salary?

First things first, you might be wondering what influences a mortgage officer's paycheck. Well, there are a few key factors at play:

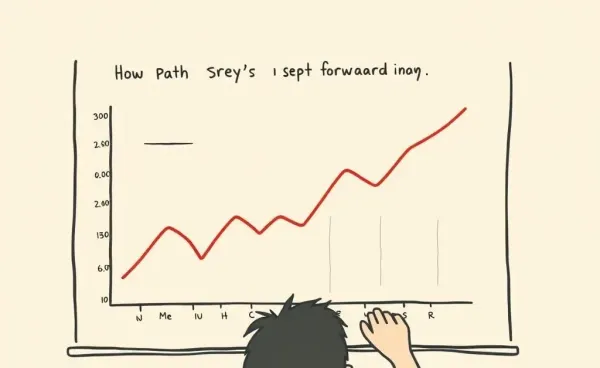

- Experience Level: As with many careers, the more experienced you are, the higher your earning potential. A seasoned mortgage officer will typically have a higher salary than someone just starting out.

- Location: Geography matters. Salaries can vary significantly depending on where you operate. A mortgage officer in a bustling city might earn more than those in small towns due to the cost of living and market demand.

- Employer Type: Whether you work for a big bank, a mortgage brokerage, or as an independent, your employer type will influence your pay structure. Large institutions may offer a steady salary, whereas brokers might work on commission.

- Performance: Like any sales-oriented role, your performance can significantly boost your income. Meeting or exceeding sales targets often brings bonuses and incentives.

Salary Ranges: What Can You Expect?

On average, a mortgage officer's salary can range, with entry-level roles starting around $40,000, while seasoned professionals might see upwards of $80,000 or more annually. Keep in mind that commissions and bonuses are common, which can substantially augment your earnings.

Navigating Your Career Path

Thinking long-term? It's important to consider how you can advance within the industry. Here are a couple of strategies to consider:

- Continuous Learning: Stay updated with the latest in mortgage trends, regulations, and tools. This not only makes you more effective in your current role but also prepares you for promotions.

- Networking: Don’t underestimate the power of building connections. Attend industry events and join professional groups. These networks can lead to new opportunities and insights into emerging market trends.

Ultimately, a career as a mortgage officer can be both rewarding and lucrative if navigated thoughtfully. I'd love to hear from you—are you considering this career path, or do you have any stories from the field? Let’s connect and share insights!