Understanding Personal Finance: Practical Tips for Everyday Money Management

Discover practical tips to manage your finances effectively and achieve long-term financial health.

Let’s face it, personal finance can feel downright daunting sometimes! But with the right tools and mindset, managing your money doesn’t have to be a chore. Whether you’re trying to pay off debt, save for a dream vacation, or just make it to the end of the month, there are practical steps you can take to ensure you’re on the right track.

Why Budgeting Is Your Best Friend

Budgeting might not sound glamorous, but it's the foundation of any solid financial plan. When you budget, you’re not just tracking expenses — you’re taking charge of your financial future. Start by jotting down all your income and expenses, and look for areas where you can cut back.

Quick tip: Treat your savings as a non-negotiable expense, like rent or utilities. Pay yourself first!

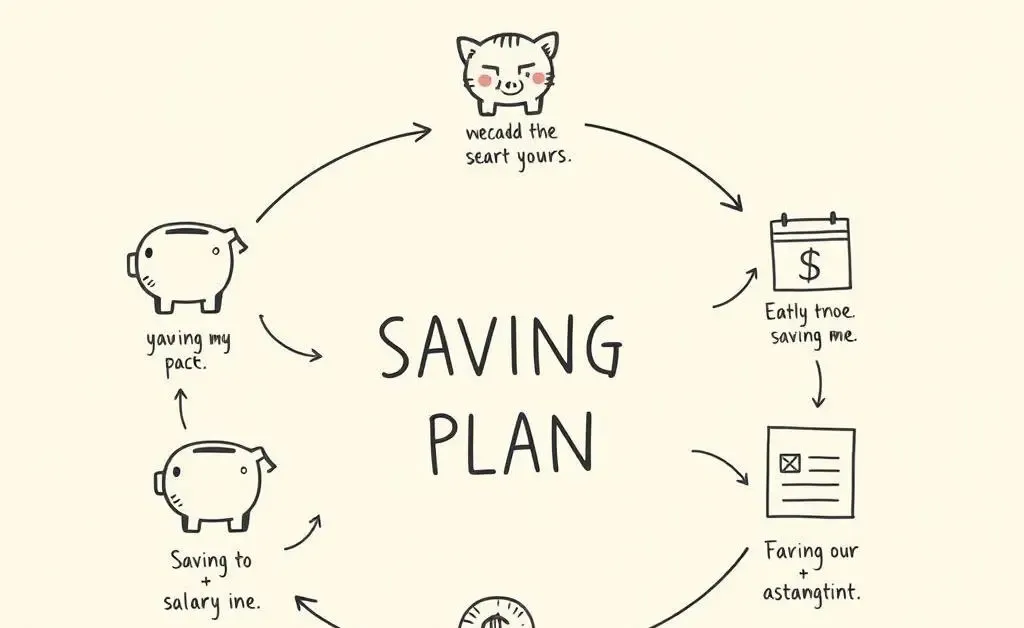

Building a Simple Savings Plan

Saving money doesn't have to be complicated. Begin with setting realistic savings goals. Remember, it’s not about how much you save but the habit of saving itself. Consider automating your savings — it’s a set-and-forget way to build your nest egg. Here's a simple flowchart to help visualize your savings journey:

Investing: More Than Just Stocks and Bonds

Investing can be an incredible tool for growing your money over the long term, but it’s important to diversify. That means not putting all your eggs in one basket. You might consider index funds, real estate, or even dipping a toe into the world of digital currencies. The right investments depend on your individual risk tolerance and financial goals.

If you're new to investing, start small, do your research, and consider reaching out to a financial advisor if you're unsure. The magic of compound interest means starting today can make a big difference tomorrow.

The Takeaway: Your Money, Your Rules

Being proactive about your finances can seem overwhelming, but with each small step, you gain more control. Create a budget, build a savings plan that works for you, and explore diverse investment opportunities. The journey to financial health is unique for everyone, so don’t hesitate to find what works best for you.

What’s your next financial goal? Let’s chat in the comments below!