Understanding PMI: A Guide to Saving on Your Home Loan

Discover what PMI is and learn practical ways to avoid it when securing a home loan.

Buying a home is an exciting milestone, but it often comes with its own set of financial puzzles to solve. If you've ever embarked on the home buying journey, you might have heard about something called Private Mortgage Insurance, or PMI. But what exactly is PMI, and how can you steer clear of it?

What is PMI?

PMI is a type of insurance that protects the lender in case you stop making payments on your home loan. It's generally required if your down payment is less than 20% of the home's purchase price. While it's a boon for lenders, it might feel like an unnecessary burden for you. After all, who likes the idea of paying for insurance that doesn't directly protect them?

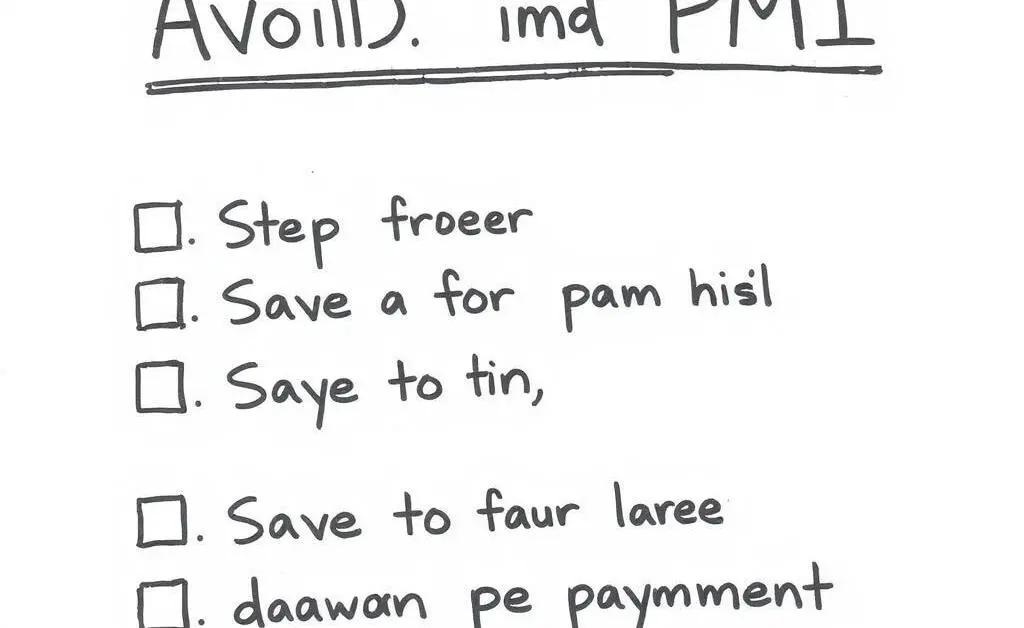

How Can You Avoid PMI?

Good news: avoiding PMI isn't as hard as it sounds. Here are a few strategies you can consider:

- Save for a Larger Down Payment: Avoid PMI by putting down at least 20% of the purchase price.

- Consider Piggyback Loans: Take out a second mortgage to cover part of your down payment.

- Look into Lender-Paid PMI: Some lenders offer this option, though it typically results in a higher interest rate.

- Opt for VA Loans: Veterans and active service members may qualify for VA loans that don't require PMI.

A Personal Anecdote

Let me share a story about my friend Sarah. Like many of us, she felt overwhelmed by the thought of PMI. But being the smart cookie she is, Sarah decided to buckle down and save aggressively to reach that magical 20% down payment mark. It wasn't easy, with fewer Starbucks runs and a brief love affair with homemade lunches, but she did it. When Sarah finally received the keys to her new home, her smile said it all.

Conclusion

Understanding and avoiding PMI can seem daunting at first, but with a bit of planning and creativity, it's definitely within reach. What's your biggest challenge when it comes to buying a home? Let’s chat about it!