Understanding PMI and Smart Ways to Avoid It in Your Loan Journey

Discover what PMI is and tips to avoid it effortlessly. Save money and stress with practical insights.

Ever felt like finance jargon was a second language? You're not alone! Many of us stumble upon terms like PMI while navigating the homebuying journey, scratching our heads and wondering what exactly it is and how to dodge it.

What Exactly is PMI?

PMI, or Private Mortgage Insurance, is a type of insurance that lenders require from homebuyers when their down payment is less than 20% of the home's value. Essentially, it protects the lender in case you default on your loan. But here's the catch - while it secures the lender, it doesn't safeguard you at all.

How Does PMI Affect Your Wallet?

PMI can sneak up on you with costs ranging from 0.3% to 1.5% of the initial loan amount, recurring as part of your monthly mortgage payment. Over time, those added payments can sum up to a hefty chunk of change that does little more than cushion your lender's risk.

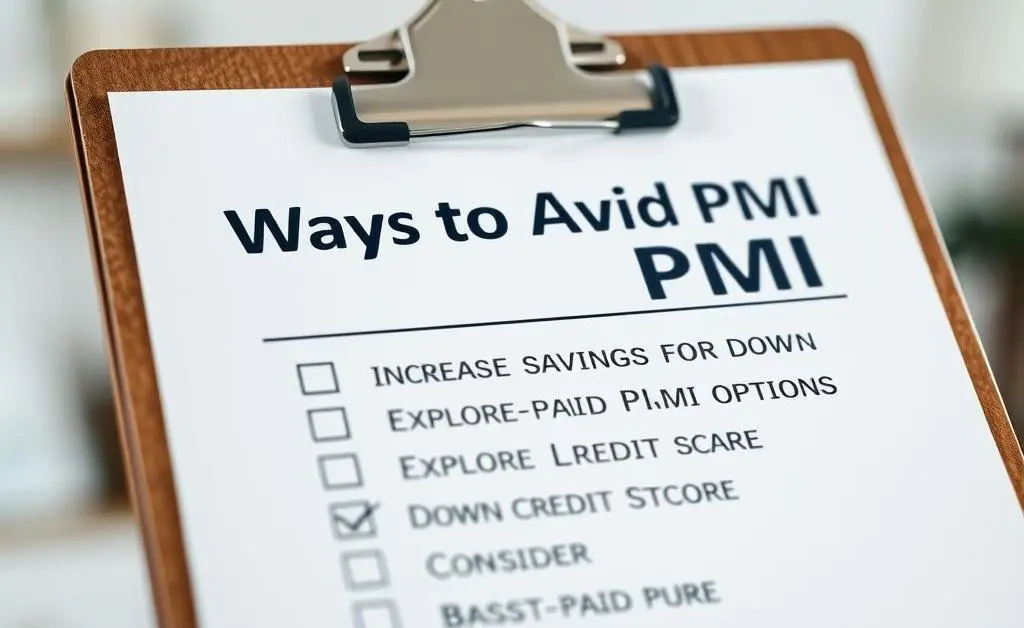

Smart Ways to Sidestep PMI

- Save More for a Down Payment: Aim for that golden 20% down payment. It might take a bit longer, but skipping PMI is like receiving a coupon for your mortgage every single month.

- Lender-Paid PMI: Some lenders offer to pay your PMI, trading off with a slightly higher interest rate. This might work for you if you plan on staying in the home long-term.

- Combination Loans: These 'piggyback loans' allow you to cover 80% of the purchase with a traditional mortgage and finance the remainder through a secondary loan.

Consider this story: a friend decided to invest in their first home. Initially, the daunting task of a 20% down payment felt impossible, but with a bit of budget planning and determination, they skipped PMI and saved themselves thousands over the loan's life.

Is Avoiding PMI Always the Right Choice?

While avoiding PMI sounds ideal, it's crucial to evaluate your unique situation. Sometimes entering the housing market sooner, even with PMI, can be more cost-effective than waiting. Property value increases could offset those extra expenses, so weigh your options carefully.

As you contemplate homeownership, remember, every financial journey is unique. What have you found most challenging about navigating the home loan landscape?