Understanding PMI: What It Is and How to Avoid It

Learn how to avoid PMI on your home loan and save money.

If you've ever dipped your toes into the home buying world, you've probably come across the term PMI or Private Mortgage Insurance. I know it sounds intimidating, like a hidden monster ready to gobble up your savings. But fear not! We're here to talk about what PMI really is, why it exists, and crucially, how to avoid it.

What is PMI?

In simple terms, PMI is insurance that your lender might require if your down payment is less than 20% of the home's purchase price. It's designed to protect the lender in case you stop making payments. While PMI makes it easier to get into a home with a smaller down payment, it also adds extra costs to your monthly mortgage payment.

Why Do Lenders Require PMI?

Think of PMI from the lender's perspective. If you're putting down less than 20%, the lender is taking on more risk. PMI shifts some of that risk away by ensuring the lender doesn't face financial loss if you default on your loan.

How Can You Avoid PMI?

Here's the good news: PMI isn't permanent – and there are strategies to sidestep it altogether. Here are a few:

1. Make a Large Enough Down Payment

The most straightforward way to dodge PMI is to make a down payment of at least 20%. I know, easier said than done, but it saves money in the long run.

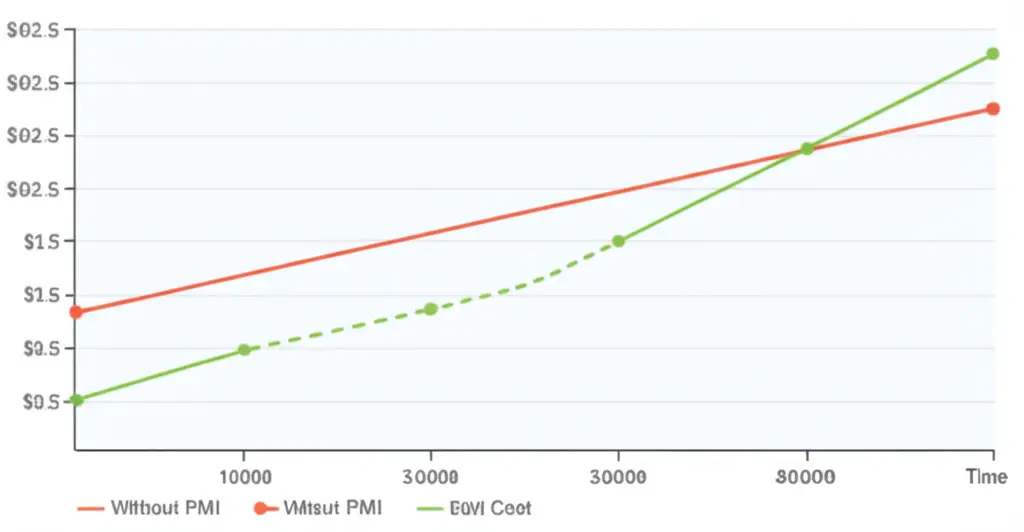

2. Explore Lender-Paid PMI

Some lenders offer to pay PMI on your behalf, but they might charge a higher interest rate in return. It could be worth considering if the numbers work in your favor.

3. Opt for a Piggyback Loan

This involves taking out two loans: one for 80% of the home's value and another to cover the 10% or 15% of the purchase price. The second loan helps cover the gap, so you don't need PMI.

When Can PMI Be Removed?

Once your equity in the home reaches 20%, you might be eligible to cancel PMI. Keeping track of your equity and being proactive can lead to significant savings.

Conclusion

PMI isn't the enemy, but it is an extra cost that savvy home buyers aim to minimize. By saving for a larger down payment, understanding your loan options, and monitoring your equity, you can either avoid PMI or remove it as soon as possible. What's your plan for approaching PMI on your home buying journey? Let's chat in the comments!