Understanding PMI: What It Is and How to Avoid It

Learn what PMI is and practical tips to avoid it during your home buying journey.

If you're venturing down the path of purchasing your first home, the acronym PMI might've caught your eye, or ears, in what might seem like an overwhelming cascade of mortgage terms. So, what exactly is PMI, and why do people try their hardest to avoid it?

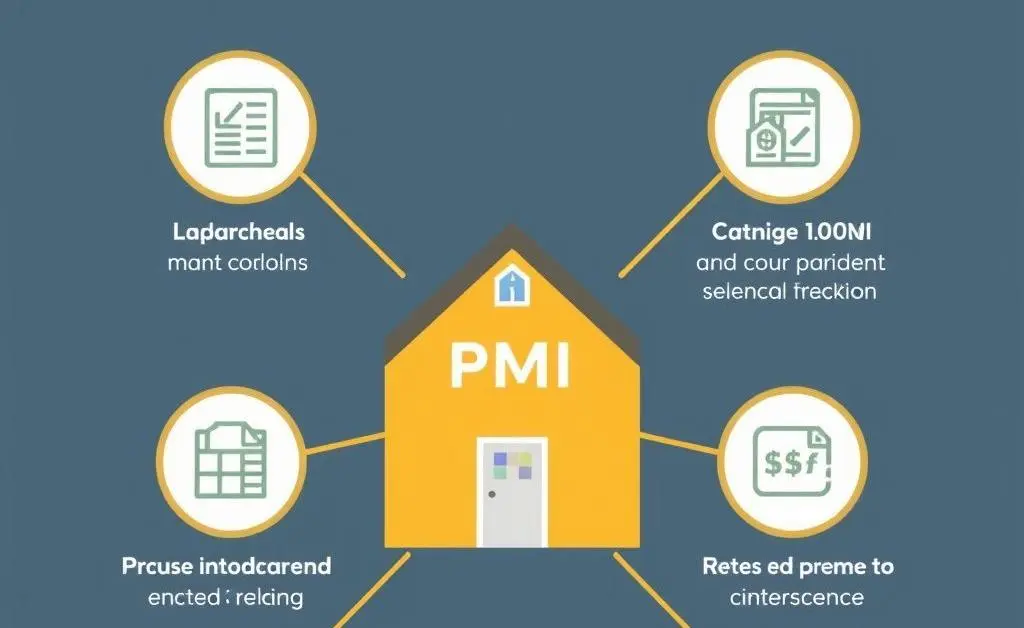

What is PMI?

PMI stands for Private Mortgage Insurance. It's a type of insurance that protects lenders from the risk of default and foreclosure. As a homebuyer, you often have to pay for PMI if your down payment is less than 20% of the home's purchase price.

A few years ago, my friend Sarah was excitedly navigating the home-buying process. Amidst the excitement, she stumbled upon PMI. To her, it was an unexpected expense, much like finding a $20 parking ticket under her car windshield.

How Can You Avoid PMI?

- Save for a Larger Down Payment: If there's one surefire way to sidestep PMI, it's by placing at least 20% down on the home's purchase price. This eliminates the need for PMI altogether.

- Consider a Piggyback Loan: You can also look into an 80-10-10 loan, where you put 10% down and get a mortgage for 80% of the home’s value. The remaining 10% comes from a second loan.

- Explore Lender-Paid PMI: Some lenders offer to cover the PMI, but this usually means a higher interest rate on your mortgage.

While contemplating these options, Sarah decided to cut back on non-essential expenses, similar to skipping that daily coffee shop detour. In time, she saved enough for a 20% down payment and bypassed PMI entirely.

A Practical Approach to Saving

Ponder this: if you're looking to avoid extra costs, such an approach might serve you well in other areas of your financial life too. How much might cutting small, recurring expenses lead to significant savings over time?

Navigating the world of home buying is no small feat. It’s a journey rich with opportunities to learn, face challenges, and make impactful choices. So, as you ponder your options and prepare for this exciting new chapter, what are some strategies you plan to use in avoiding PMI, or managing your overall home-buying expenses effectively?