Understanding PMI: Why It Matters and How to Avoid It

Discover what PMI is and how to sidestep it when buying your dream home.

So, you’re ready to dive into the world of homeownership—congrats! It’s a grand adventure, but it can feel a bit like untangling a digital jungle with all the terms and guidelines flying around. One term that often pops up is PMI, or Private Mortgage Insurance. Let's explore what it is and how you can avoid it.

What is PMI?

PMI stands for Private Mortgage Insurance, and it's essentially an insurance policy that protects your lender. When you don't have a big enough down payment—usually 20% of the home's value—lenders see you as a bit riskier. PMI steps in to reassure them. Unfortunately, it doesn’t protect you, the buyer. It just means extra monthly payments for you.

Why is avoiding PMI beneficial?

No one enjoys doling out money for something that doesn't benefit them directly, right? Avoiding PMI can save you thousands over the life of your loan. Lower monthly payments are certainly appealing, giving you more room to breathe financially and perhaps even enjoy a few more lattes.

How can you avoid paying PMI?

First, aim for that golden 20% down payment. Yes, it's hefty, but totally worth it. Creating a dedicated savings plan could be your best ally here. Imagine a cozy weekend armed with your budget spreadsheet, candles flickering in the background, and a big mug of tea in your hand. It's strategy time.

Explore loan options

Some loans don’t require PMI, even without 20% down. VA loans for veterans or loans through smaller community banks sometimes offer PMI-free options with lower down payments.

Consider a piggyback loan

If you’ve got some savings but not quite 20%, a piggyback loan might help. It allows you to take a second loan simultaneously with your primary mortgage, effectively raising your down payment to that sweet spot and dodging PMI.

Is it better to pay PMI?

While paying PMI isn’t ideal, it allows you to purchase a home sooner if you're close but not quite at that 20% mark. For some, getting into a home quicker outweighs the annoyance of PMI.

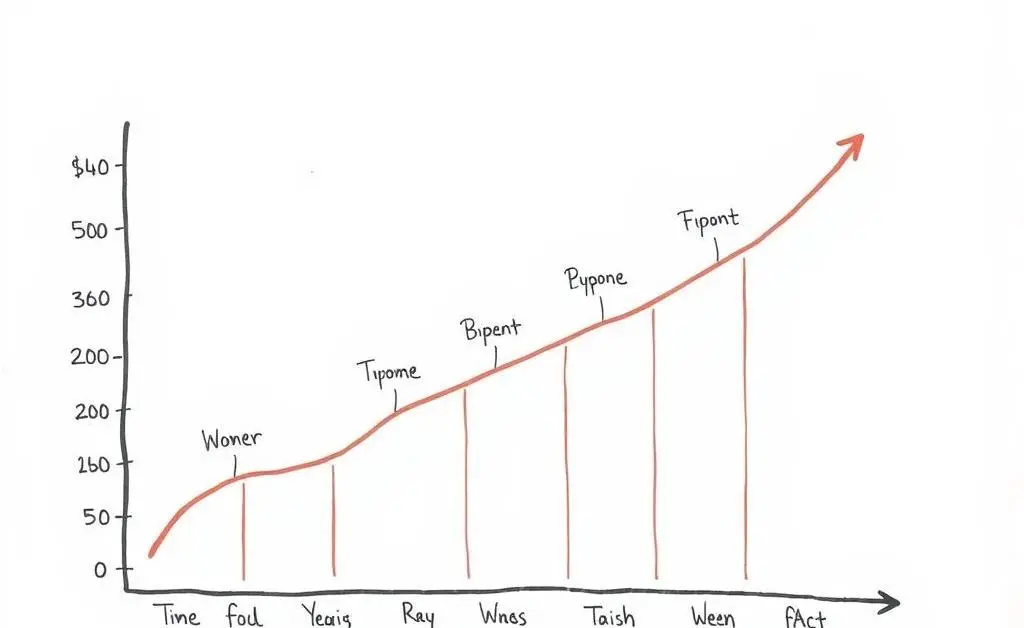

As you weigh these options, remember it's not just about today, it's about building for your future. Imagine yourself achieving those financial milestones on your path.

Final thoughts

Buying a home is a big step—and PMI is just one small piece of the puzzle. By understanding your options and planning, you can set yourself up for a smoother, more financially savvy home buying journey. Here's to fulfilling dreams and financial empowerment!