Understanding Provisional Credit: What Happens When Transactions Go Awry

Discover how provisional credit works and what to expect during transaction disputes.

Have you ever spotted an unfamiliar charge on your bank statement and wondered, "What now?" If so, you're certainly not alone. Many people find themselves puzzled when unexpected transactions pop up. Rest assured, banks have a process called provisional credit to help navigate these situations.

What is Provisional Credit?

Provisional credit is a temporary deposit into your account while your bank investigates a disputed transaction. Think of it as a financial safety net that holds tight until everything is sorted out. This ensures you're not out of pocket while the bank digs into the details. But let's not get ahead of ourselves; there's more to the story.

The Provisional Credit Timeline

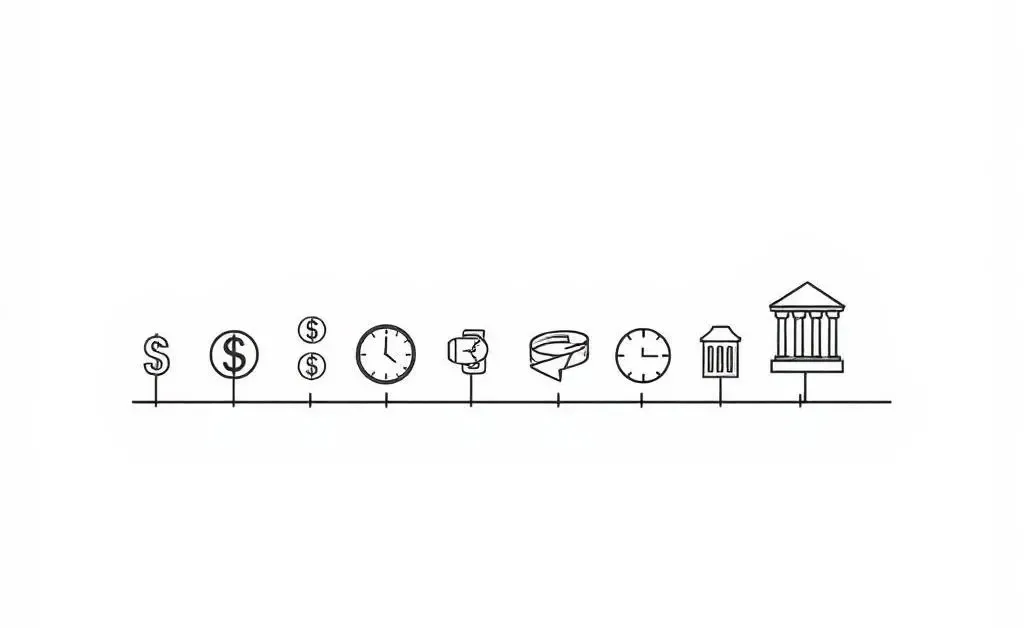

Now, timing is everything, right? Here’s a typical timeline of events:

- Day 1-2: Spot the anomaly and contact your bank. They'll start the ball rolling by noting your dispute.

- Day 3-5: The bank issues provisional credit, so you have access to your funds while they investigate.

- Day 45: Usually, investigations wrap up within this period, pending any complexities.

- Resolution Day: Once concluded, your provisional credit becomes permanent, or if the claim isn’t upheld, it's reversed.

It sounds straightforward, but the wait can be nerve-wracking. Remember, laughter is a great stress-reliever. Ever accidentally drop a bit too much on a midnight snack, and the bank calls it "suspicious activity"? Yeah, me too!

Common Concerns About Provisional Credit

You might wonder how long this all takes or if there are fees involved. Generally, banks complete their investigations within 45 days, but it could extend up to 90 days for international transactions. The good news? There typically aren’t any fees when you dispute a charge. However, if the dispute isn’t found in your favor, the credit may be reversed. Yikes!

The Silver Lining

Despite its potentially daunting nature, provisional credit often leads to a pleasant conclusion. It serves as a temporary fix that lets you breathe easy while the bank does the heavy lifting. Think of it as having a financial guardian angel, ready to swoop in when things get tricky.

Wrapping it Up

In the whirlwind world of finance, unforeseen blips like disputed transactions happen. Yet, with provisional credit, banks extend a reassuring hand to help you through. Have you ever had an interesting or quirky dispute experience? I'd love to hear about your adventures in financial resolutions!