Understanding Roth IRAs: Your Guide to Smart Retirement Savings

Explore how Roth IRAs work, benefit your finances, and grow your savings

When I first started exploring retirement savings options, I stumbled upon the term Roth IRA and found myself drowning in a sea of financial jargon. If you’ve ever been in the same boat, fear not! I’m here to demystify the Roth IRA and share why it might be a smart choice for your retirement plan.

What is a Roth IRA?

A Roth IRA isn’t some mystical financial instrument. In simple terms, it’s a type of retirement account that lets your investments grow tax-free. This means that the money you contribute has already been taxed, and your earnings, given you follow the rules, can be withdrawn tax-free during retirement. Sounds like a win-win, right?

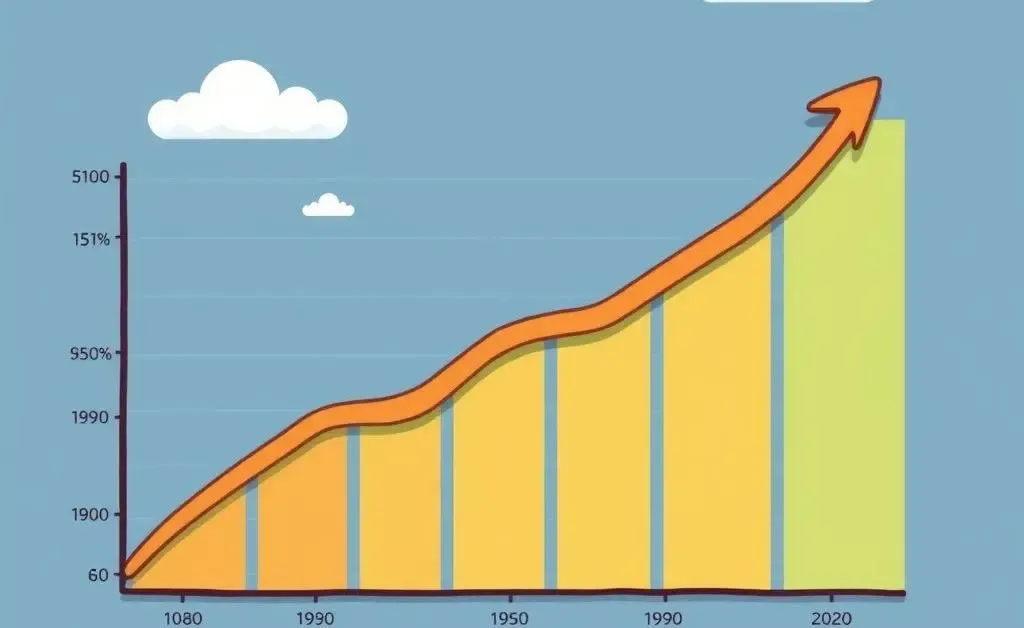

How Does a Roth IRA Grow?

You might be wondering, "Does a Roth IRA earn interest?" The short answer is: not directly. A Roth IRA isn’t an interest-bearing account like a savings account. Instead, it’s an investment account, which means its growth potential relies on the assets you choose to invest in—such as stocks, bonds, or mutual funds.

Think of it as planting a garden. The seeds you sow represent your contribution, and how you nurture them—through smart investment choices—determines the harvest you’ll reap.

Why Choose a Roth IRA?

One of the greatest perks of a Roth IRA is the flexibility it offers. Unlike traditional IRAs, Roth IRAs provide tax-free withdrawals during retirement, which can be a golden ticket if you anticipate being in a higher tax bracket in the future. Plus, there are no required minimum distributions, so you can let your savings grow for as long as you want.

Who Can Benefit the Most?

Young investors or those currently in a lower tax bracket are often prime candidates for a Roth IRA. By paying taxes upfront, you’re banking on the benefit of tax-free income when you might need it the most. Even if retirement seems lightyears away, time is a powerful ally. The earlier you start contributing, the more your investments have the potential to grow.

Are There Any Downsides?

Like everything in life, the Roth IRA comes with a few caveats. There are contribution limits based on your income level, and withdrawing earnings before age 59½ could trigger taxes and penalties. But with careful planning, these hurdles are easily navigated.

In the end, whether a Roth IRA is the perfect fit depends on your individual financial goals and circumstances. The key takeaway here is to get informed and choose what aligns best with your future plans.

Wrapping Up

I hope this deep dive into the Roth IRA has sparked some ideas on how to optimize your retirement savings. Curious to know more? Feel free to reach out with questions or share your own journey towards building a financially secure future.