Understanding Stock Buybacks: A Friendly Guide to Navigating Financial Choices

Explore the nuances of stock buybacks and their impact on your investments.

Recently, I found myself cozied up with a cup of tea, pondering the intricacies of stock buybacks. If you've ever felt a bit fuzzy about what they mean for your investments, you're not alone. Stock buybacks are like a warm puzzle, and we’re going to piece it together today.

What Are Stock Buybacks Anyway?

A stock buyback, simply put, is when a company buys its own shares back from investors. This can feel a bit like a company investing in itself, showing confidence in its own future. But it also reduces the number of shares available, potentially increasing the value of the remaining ones.

Why Do Companies Buy Back Shares?

Companies might choose this path for several reasons. Perhaps they believe their stock is undervalued, or they see it as a strategic use of excess cash. Another factor could be to improve financial metrics like earnings per share. It's both a signal to investors and a financial strategy.

Should You Care About Buybacks?

You might be wondering whether this impacts your investment choices. When companies initiate buybacks, it can be a positive signal, suggesting they have faith in their long-term success. However, buybacks also mean using funds that could be invested elsewhere, like in research or expanding the business. It’s a balancing act – one that doesn’t have a one-size-fits-all answer.

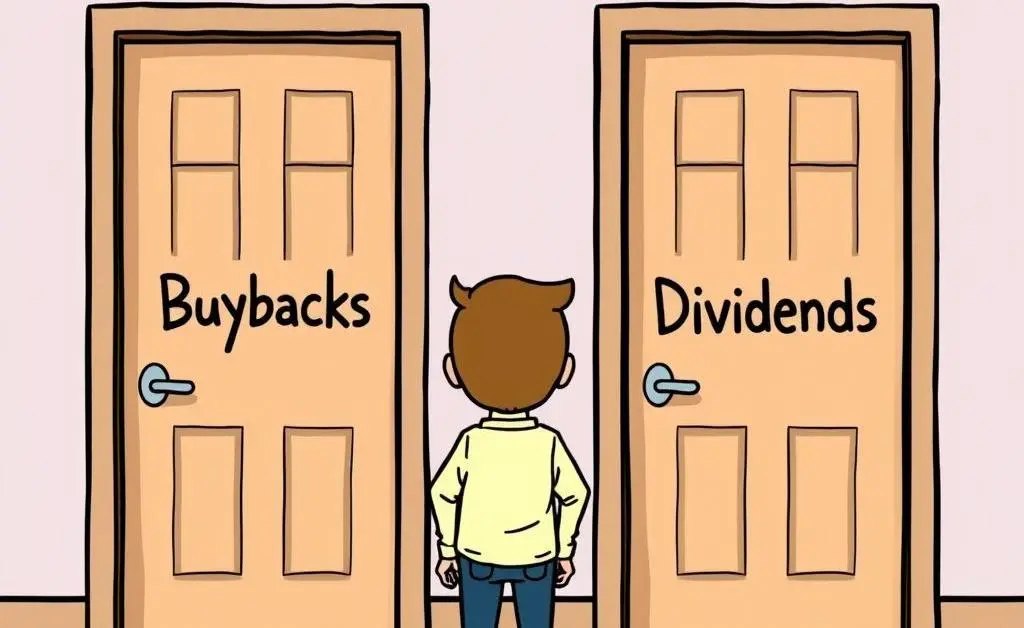

Comparing Buybacks and Dividends

Both buybacks and dividends return value to shareholders, but in different ways. Buybacks can give the benefit of increased share value, while dividends offer immediate, tangible returns. Your preference might hinge on your financial goals and whether you're in it for the long haul or prefer more immediate gains.

Final Thoughts: Your Move

There’s no universal answer to whether stock buybacks are good or bad for you. It’s about understanding the bigger picture and aligning it with your financial goals. As we sip our tea and ponder life’s financial choices, it’s comforting to know that the right decision is one that feels right for you. Take what fits, and leave the rest. After all, investment decisions are as personal as that favorite tea blend you keep returning to.