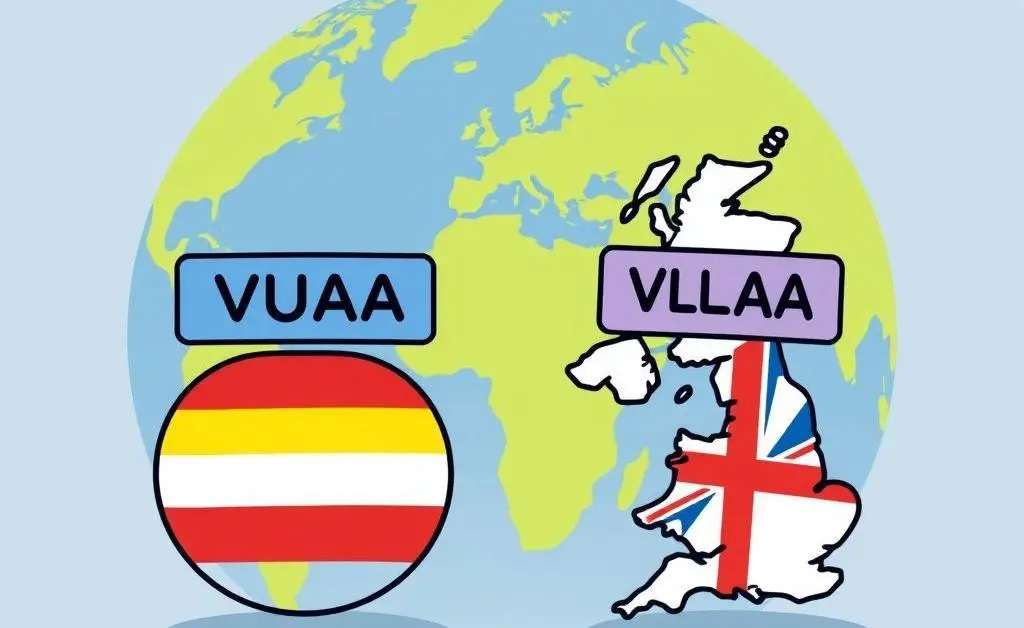

Understanding the Difference Between VUAA DE and VUAA UK ETF Choices

Learn the key differences between VUAA DE and VUAA UK ETFs and make informed investment decisions.

Have you ever found yourself staring at your computer screen, trying to decipher the difference between similar-sounding ETFs? You're not alone! When it comes to VUAA DE and VUAA UK, many investors have been scratching their heads. Let's break it down so you can feel confident in your investment choices.

What Sets VUAA DE Apart?

VUAA DE is an ETF listed on the Deutsche Börse, and it draws significant attention from investors who prefer trading in Euros. One of the favorable aspects is its tax considerations – crucial if you're residing in a Eurozone country or have investments tied to this currency. Remember, the currency exchange rates can play a substantial role in your returns!

Understanding VUAA UK

Meanwhile, VUAA UK is listed on the London Stock Exchange and traded in British Pounds. It's a prime choice for those invested in the UK market or who already deal in GBP. The regulations and market dynamics of the UK also influence this ETF in unique ways, catering specifically to local preferences.

Key Differences at a Glance

- Currency: VUAA DE trades in Euros; VUAA UK trades in British Pounds.

- Market of Listing: VUAA DE is listed on the Deutsche Börse; VUAA UK is on the London Stock Exchange.

- Tax Implications: Investors may experience different tax obligations depending on their country of residence and the ETF chosen.

My Personal ETF Exploration Tale

Once upon a time, I was a novice investor trying to wade through the murky waters of ETFs. After spending countless hours researching, I eventually chose VUAA DE due to its Euro alignment. Fast forward a few years, and I learned that tax implications played a bigger role in my returns than I initially thought! It was a valuable lesson in the intricacies of international investments.

Final Thoughts: Picking the Right ETF for You

Ultimately, your choice between VUAA DE and VUAA UK should align with your financial goals, currency preferences, and tax considerations. As always, do your due diligence and consult a financial advisor if needed.

So, which ETF will support your financial future? Have you had any surprising encounters while navigating ETF options? Share your story, and let's keep the conversation going!