Understanding the Evolving Role of Underwriting in Insurance

Learn how underwriting in insurance is changing and what it means for you.

Ever wondered why your insurance premium is set at its specific rate? Or what that maze of numbers and terms means exactly when you're applying for a new policy? The secret behind these intricacies lies in the enigmatic world of insurance underwriting. Today, we're diving deep into how underwriting is evolving and what this means for both professionals and policyholders.

What is Insurance Underwriting?

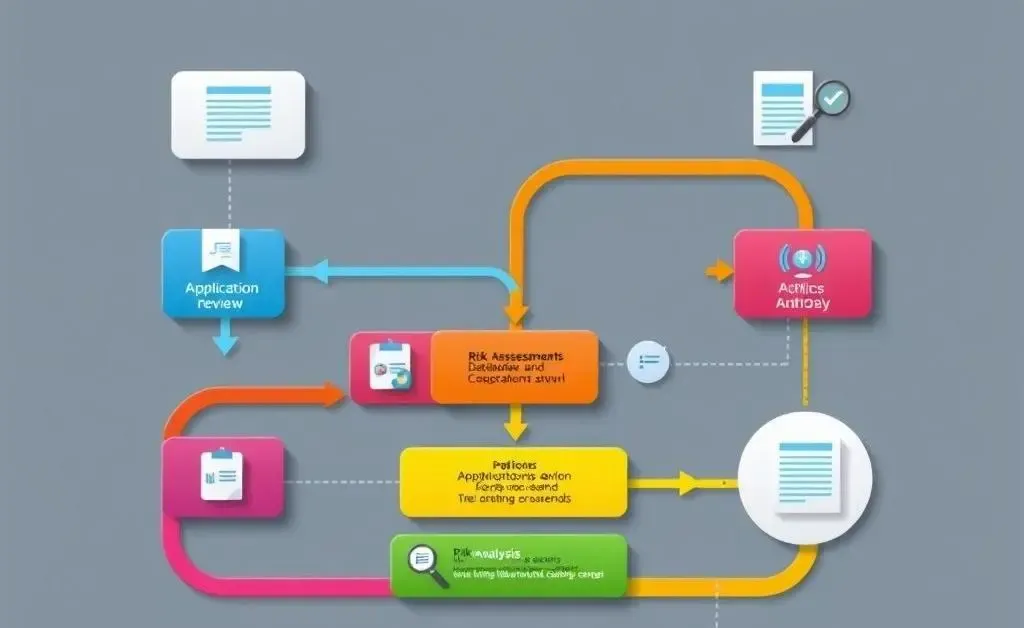

At its core, insurance underwriting is about assessing risk. It's that magical black box where insurers decide your risk as a policyholder and, consequently, the cost of your premium. Think of it as the gatekeeper of the insurance world, blending data with a dash of human intuition to assign risk accurately.

Changing Roles: What's New in Underwriting?

The role of underwriting has been shifting, especially with the advent of smart technologies and the endless flow of data. Here are a few ways underwriting is changing:

- Data-Driven Decisions: Enhanced analytics allow underwriters to make more accurate predictions, adjusting policies in real-time.

- Automation: Routine tasks are now often automated, freeing underwriters to focus more on complex decision-making.

- Evolution of Risk Models: New types of insurance products are emerging to meet the needs of evolving risks, like cyber threats.

Remember Laura? Let me tell you a story about my friend, Laura. She recently switched insurance providers after doing some research into how different companies determine their rates. What she found was fascinating. While her previous provider relied heavily on credit scores, her new one focused on lifestyle data. This shift in underwriting approach led to lower premiums for Laura, proving that not all underwriting processes are created equal.

The Impact of Technology on Underwriting

The intersection of technology and underwriting has opened new doors:

- AI & Machine Learning: These technologies help analyze vast amounts of data quickly, uncovering patterns that even the best human analyst might miss.

- Blockchain: With enhanced security features, blockchain technology ensures data integrity which is crucial for underwriting decisions.

As these technological advancements continue to grow, they not only enhance accuracy but also improve the customer experience, making the insurance process less daunting.

How Does This Affect You?

For insurance professionals, staying abreast of these underwriting trends is vital, while as policyholders, understanding these changes can benefit you economically. An informed consumer can ask the right questions and select the best-suited policies.

At the end of the day, whether you're an industry professional or simply someone ensuring that your assets are protected, knowing that the underwriting structures continue to evolve is empowering. What's your take on this? Have you noticed any changes in your interactions with insurance? Let me know!