Understanding the Federal Rate Cuts: Your Guide to Inflation and Interest Rates

Dive into the reasons behind the Federal rate cuts and what it means for you.

Have you ever wondered why the Federal Reserve would cut interest rates, or what it really means when they do? Understanding the waves of inflation and interest rates can feel like learning a new language, but it doesn't have to be complicated. Let’s dive into the reasons behind these rate cuts and what they mean for you and me.

Why Does the Fed Cut Rates?

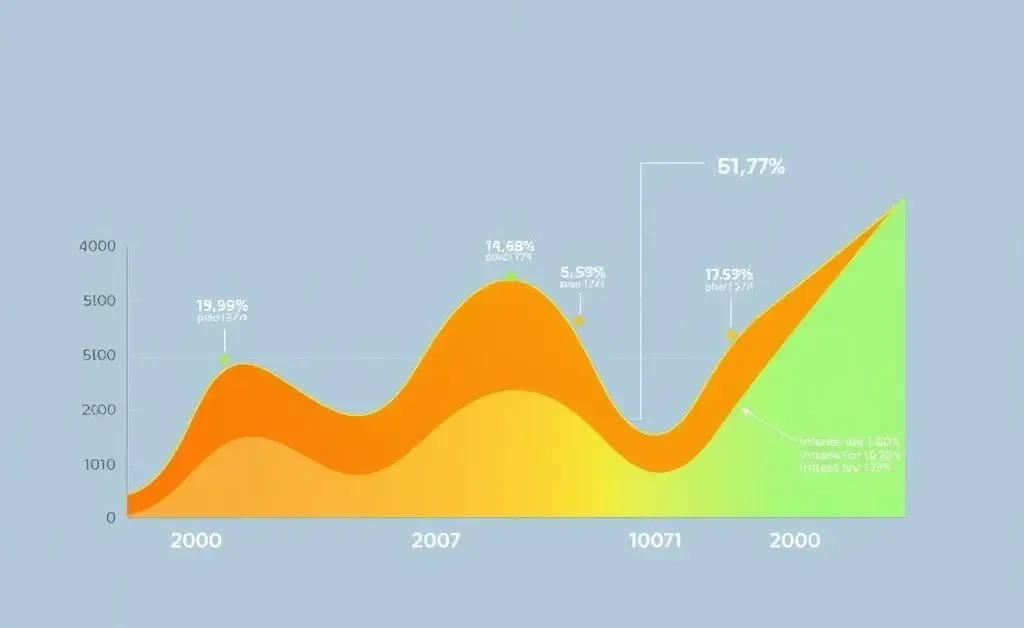

The Federal Reserve often cuts interest rates to stimulate economic growth. When borrowing is cheaper, businesses and consumers are more likely to spend, which propels economic activity. But what happens when the inflation target adjusts? That’s the big question being discussed lately.

The Changing Inflation Target

Recently, there’s been chatter about inflation targets moving from the traditional 2% to around 3%. Why the shift, you ask? It’s all about balance. When the economic climate changes, targets adapt to ensure stability. This change is an attempt to accommodate evolving economic conditions without stalling growth.

How Does It Impact Us?

Imagine you're planning a big family vacation. Lower interest rates might mean you consider booking it sooner rather than later or upgrading your accommodations because you can borrow at a lower rate. It’s all about timing and maximizing value. Here’s how to think about the impact of rate cuts:

- Cheaper Loans: Lower rates mean smaller interest payments on loans and mortgages.

- Savings Impact: Lower interest rates often lead to lower returns on savings accounts.

- Stock Market Influence: Investments might fluctuate based on investor confidence and market dynamics.

What's the Best Move?

Understanding these changes means we can adjust our personal finance strategies. Whether it’s a shift in investment tactics or a change in the family budget, staying informed helps us make the right decisions at the right time. If you're seeking more stability, consider consulting with a financial advisor to navigate these waters.

Here's a small anecdote for you: I once delayed renovating my kitchen because interest rates were high. When they were cut, suddenly there was room in the budget for that dream countertop! It's those little adjustments that can make a big difference.

Have recent rate changes impacted your plans in any way? What strategies are you considering to stay ahead?