Understanding the Federal Reserve: How It Affects Your Wallet

Learn how the Federal Reserve impacts your finances in a friendly, easy-to-understand way.

Hey there! Today, let's dive into something that might sound intimidating at first but is actually super important: the Federal Reserve. You might wonder, why should I care about the Federal Reserve? Well, whether you're planning your next big purchase or simply managing your monthly budget, the Fed plays a silent yet significant role in your everyday financial life.

What Does the Federal Reserve Do?

The Federal Reserve, often simply called the Fed, is like the conductor of the economic orchestra. It’s responsible for managing the economy through monetary policy. The Fed does this by controlling interest rates and regulating the money supply.

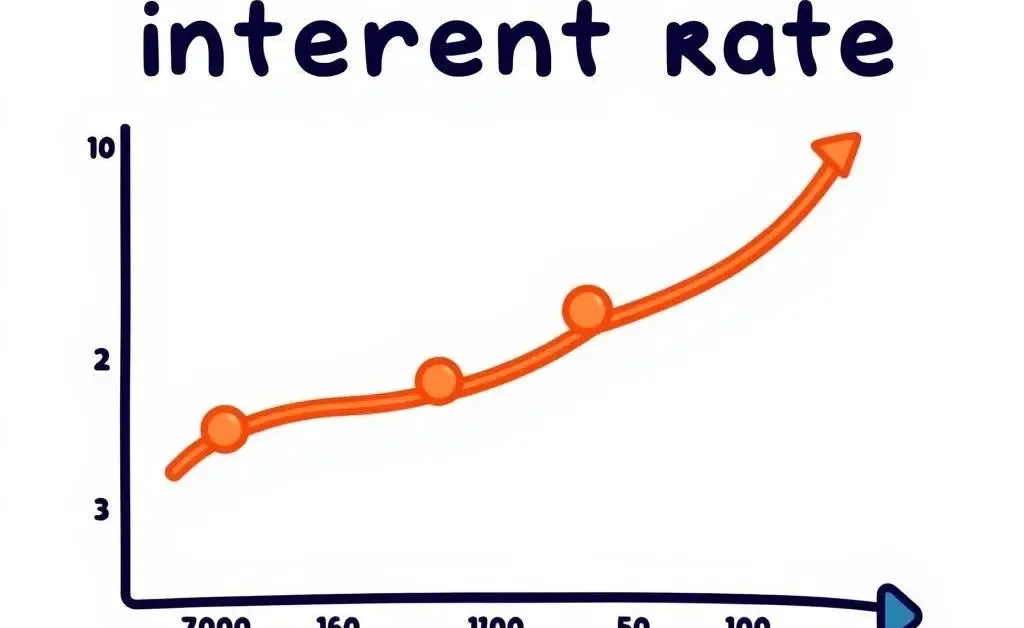

How Interest Rates Affect You

If you've ever taken out a loan or even considered it, you've encountered interest rates. These are pivotal in your financial journey. When the Fed adjusts interest rates, it influences everything from mortgage rates to credit cards and personal loans.

- Lower interest rates: Make borrowing cheaper, often encouraging spending and investment.

- Higher interest rates: Typically make saving more appealing because returns on savings investments like bonds grow.

The Fed and Inflation: What's the Connection?

Inflation is another topic intricately linked with the Fed's decisions. Simply put, inflation means that your dollars are buying less over time. The Fed aims to keep inflation at a moderate level. Too high, and everyday goods become too expensive; too low, and it can signal a virus stalling economy.

How Does This Tie Back to Your Wallet?

Every time Fed officials meet and announce new policy decisions, these changes send ripples through to your wallet. For instance, if the Fed signals a rise in interest rates, expect the cost of borrowing money to rise, which can affect loans and credit card interest rates you already have or plan to take on. Conversely, if they lower rates, you might find yourself paying less on your existing loans.

Final Thoughts

Wrapping up, the Federal Reserve, in essence, has a perceptible impact on how you manage your money. Understanding the basics of what they do and how their decisions affect inflation and interest rates can empower you to make more informed financial choices. So, the next time you hear about Fed meetings, you might just tune in with a bit more curiosity and personal insight.

What aspect of Fed policy do you find affects you the most? Share your thoughts, and let's keep the conversation going!