Understanding the Impact of Lower Interest Rates on Your Investments

Explore how lower interest rates affect your investment strategy and uncover thoughtful tips for adapting your financial plans.

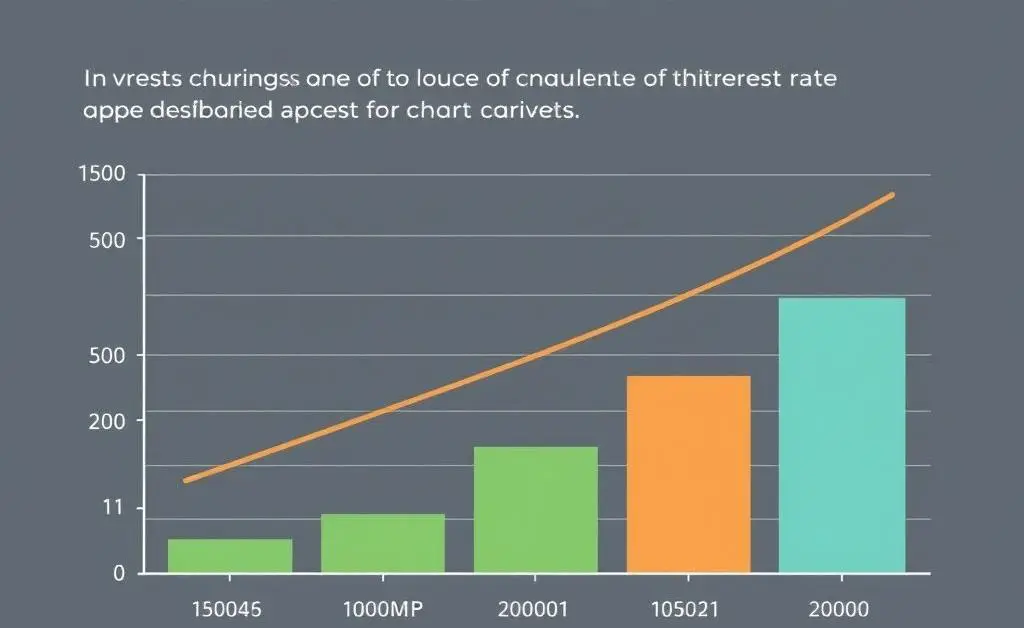

Have you ever found yourself pondering over the implications of lower interest rates on your investment journey? It's a nuanced topic that resonates with many, especially those of us keen on thoughtfully steering our financial futures. In this post, we'll dive into the deeper effects of declining interest rates and explore how to navigate this ever-evolving landscape.

Why Do Interest Rates Matter?

Interest rates have a pervasive influence on the economy, acting as a financial fulcrum that impacts everything from the cost of borrowing to the return on investments. When rates are lowered, borrowing becomes cheaper, encouraging spending and investment. But for existing investors, particularly those relying on fixed-income streams, this change can feel like a curveball.

How Lower Rates Affect Your Investments

The first ripple you might notice is in the fixed-income arena. Lower rates can shrink yields on savings accounts and bonds, urging many to reconsider their plans. Equities, on the other hand, often benefit. With borrowing costs down, companies might invest more in growth initiatives, potentially boosting stock prices. It's akin to planting seeds in a garden where the weather promises prosperity.

However, it's vital to remember that not all sectors will thrive equally, and careful plotting remains essential.

Adapting Your Investment Strategy

Facing the reality of lower rates, it's helpful to adopt a flexible mindset. Consider diversifying your portfolio by including assets that might flourish under such conditions, like growth stocks or real estate investment trusts (REITs). It's somewhat like assembling a varied garden — different plants thrive in different conditions.

Reassessing your risk tolerance, consulting with financial advisors, or even exploring alternative investments can offer new pathways to align your financial goals with current economic conditions.

Thoughtful Planning Yields Fruitful Outcomes

Navigating the world of investments amidst fluctuating interest rates doesn't have to be daunting. By carefully realigning your strategies and embracing a flexible approach, you're better equipped to respond to the economic ebbs and flows. Remember, it's not solely about achieving short-term gains but nurturing long-term growth and stability.

As you embark on this thoughtful exploration of your financial landscape, consider what aligns not just with your goals but with your values and peace of mind. Here’s to investment planning that’s as rewarding as it is mindful!