Understanding Youth Insurance Rates: A Simple Guide

Explore the nuances of youth insurance rates and learn how young drivers can make informed choices.

When you're just starting to drive, understanding how insurance rates are determined can feel like unraveling a mystery. Let's sit down and have a chat about what really goes into determining youth insurance rates and how you—or someone you know—can navigate this with confidence.

What's Behind Youth Insurance Rates?

Getting your first insurance quote as a young driver can seem overwhelming, but don't worry—it's all about understanding the factors that companies consider. Typically, insurance rates for youth are higher due to several key reasons:

- Inexperience: With fewer years on the road, young drivers are statistically more prone to accidents.

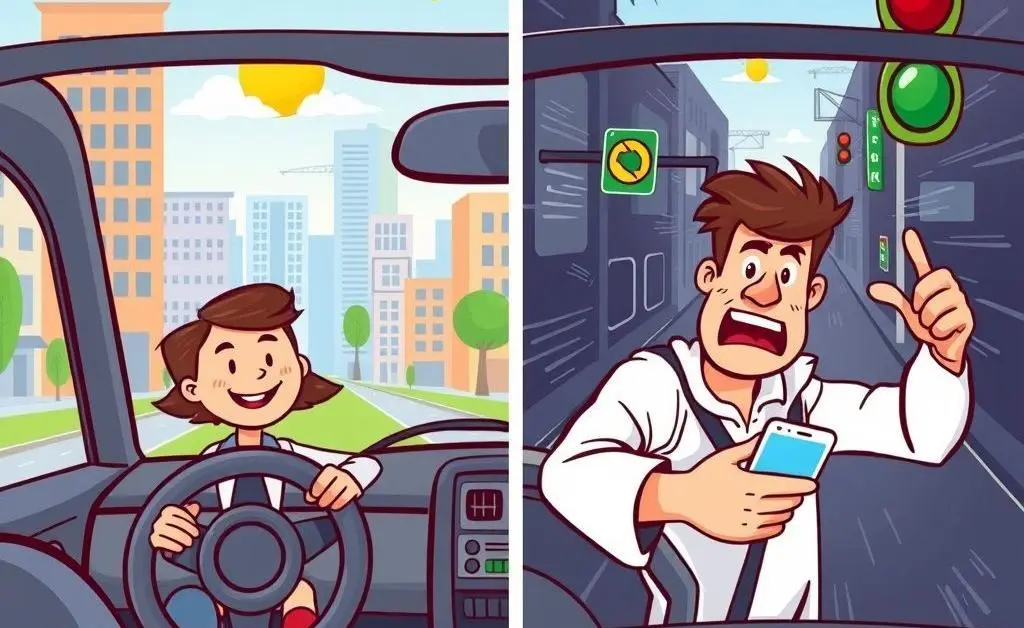

- Risk Profiles: Insurers use data showing that younger drivers might engage in riskier behavior behind the wheel.

- Vehicle Type: Insurance is also affected by what you're driving, so your choice of car matters.

How to Manage and Reduce Your Rates

Now that we know why rates are structured this way, let's talk about how we can exercise a bit of control over them. Here are some steps you can take to potentially reduce your insurance costs:

Choose Your Vehicle Wisely

Opting for a car that's deemed safe and reliable might help lower your premiums. Avoid sport cars and stick to models with good safety ratings.

Embrace Defensive Driving

Completing a defensive driving course can not only make you a better driver but also qualify you for discounts with some insurers. It's worth exploring options available near you.

Bundle Your Policies

If you're in a position to do so, consider bundling your car insurance with other policies, like health or home insurance. Most companies offer attractive discounts for this.

Let’s Keep It Transparent

Insurance might seem complex, but it's all about being informed and proactive. Taking time to research can lead you to better decisions, and over time, experience will work in your favor.

Share this newfound knowledge with someone who might need a little extra guidance, or reflect on how making these small adjustments in our driving and policy choices could create significant savings.

Final Thoughts

Understanding youth insurance rates doesn't have to be daunting. By appreciating the factors involved and taking strategic steps, you'll be better equipped to handle the financial responsibilities that come with driving. Grab a cup of tea, consider your options, and start making those informed decisions today.