Unexpected Medical Bills: How to Navigate and Reduce Costs

Learn practical steps to manage and reduce unexpected medical bills effectively.

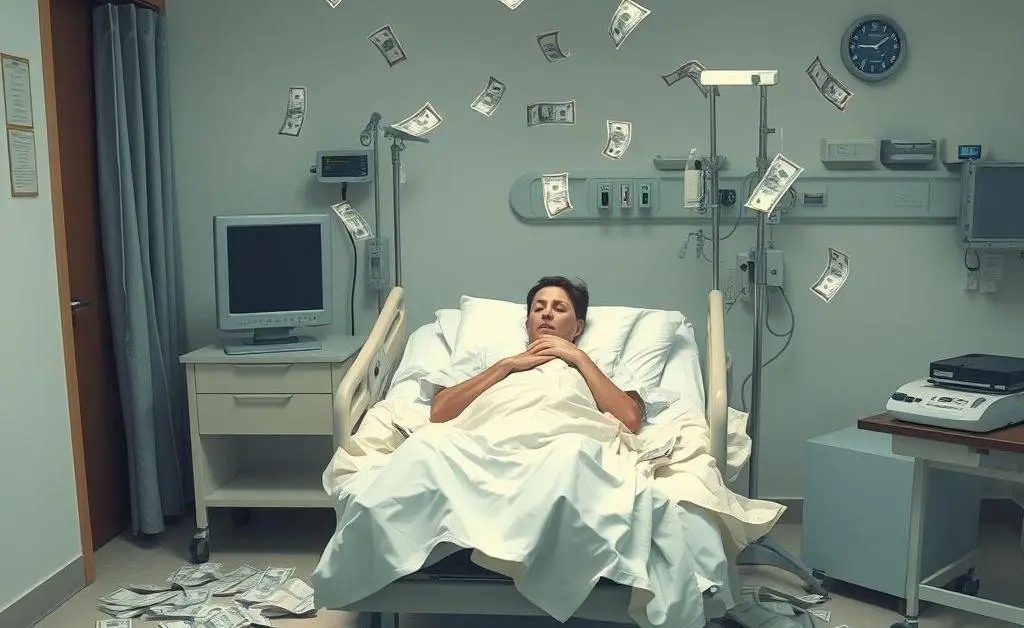

Have you ever opened a mail to find a jaw-dropping hospital bill staring back at you? It's an experience that can make anyone's heart skip a beat. But don't worry, you're not alone in this financial labyrinth. Navigating unexpected medical bills can be overwhelming, but with the right approach, you can manage these costs more effectively.

Understanding Your Bill

Before you start jumping through hoops, the first step is to break down the bill. Examine all the charges and ensure they accurately reflect the services received. Contact the provider for a detailed breakdown if anything doesn’t seem right.

Steps to Verify Your Bill

- Check for duplicate charges or services you didn’t receive.

- Compare the bill with your insurance Explanation of Benefits (EOB).

- Contact the billing department for any discrepancies.

Consider this: A fictional friend, Mike, recently faced a gigantic bill after his son’s unexpected NICU stay. He noticed multiple charges for services they declined, and after calls and emails, those charges were removed. Small clerical errors can lead to big bills!

Negotiating with Providers

Many people don't realize that medical bills are often negotiable. Yes, you can reach out to the hospital or provider and ask for a discount or negotiate a payment plan. Here’s how:

Effective Negotiation Tips

- Be polite but firm, explaining your situation clearly.

- Research typical costs for similar treatments in your area.

- Inquire about any available discounts or financial assistance programs.

Maximizing Your Insurance

Insurance can be a complex puzzle. Make sure you're using it to its fullest potential. Contact your insurer to ensure that everything billed is covered, and understand the details of what each service entails. Some steps to maximize your insurance include:

- Verifying that your healthcare provider is in-network.

- Never assuming that a service is covered; always double-check.

- Reviewing your policy annually for any updates on coverage.

Establishing an Emergency Fund

Finally, consider setting up an emergency fund dedicated to healthcare. Life is unpredictable, and a financial cushion can be a great relief during stressful times.

Start small; even setting aside a tiny amount monthly can build up over time. It's like adding a feathery pillow to soften life's unexpected falls.

Wrapping things up, have you ever found a surprising strategy that worked well when dealing with medical costs? Share your thoughts; it might just inspire someone else to find the light at the end of their bill-induced tunnel!