Unlocking Financial Confidence: A Personal Journey to Control and Success

Explore financial growth and confidence through practical budgeting tips and strategies.

Hey there! I wanted to share a personal journey with you—one that’s often full of surprises and is incredibly empowering. It's about finding financial confidence, a theme many of us gravitate towards as we navigate life's twists and turns. For me, it began with a single, daunting question: how do I start taking control of my financial future?

Setting the Foundations: Budget Like a Boss

Let’s start with the basics—budgeting. You've probably heard the term tossed around a lot. It's that trusty first step in gaining financial control. I used to find budgeting quite intimidating. But once I realized it was less about limiting freedoms and more about creating options, my perspective shifted!

Consider setting up a zero-based budget. This just means every dollar has a purpose—spend it, save it, or invest it. It's an easy way to keep track and see exactly where your money is going.

Practical Tools for Budget Management

- You Need A Budget (YNAB): A favorite for those who want to get into the nitty-gritty of their finances.

- Mint: Great for beginners. It syncs with your bank and tracks spending.

Embracing Debt as a Stepping Stone

Debt can feel like a heavy blanket, smothering potential dreams. However, seeing it as a stepping stone rather than an obstacle can transform your outlook. Take student loans or a mortgage, for instance—they’re often necessary debts that can lead to improved life quality. Just like a strategic investment, they’re all about the payoff in the long run.

Strategies for Managing Debt

To manage debt, consider the debt snowball method. It allows you to pay off smaller debts first, gaining momentum as you tackle bigger ones. There’s something exceptionally motivating about seeing those balances shrink.

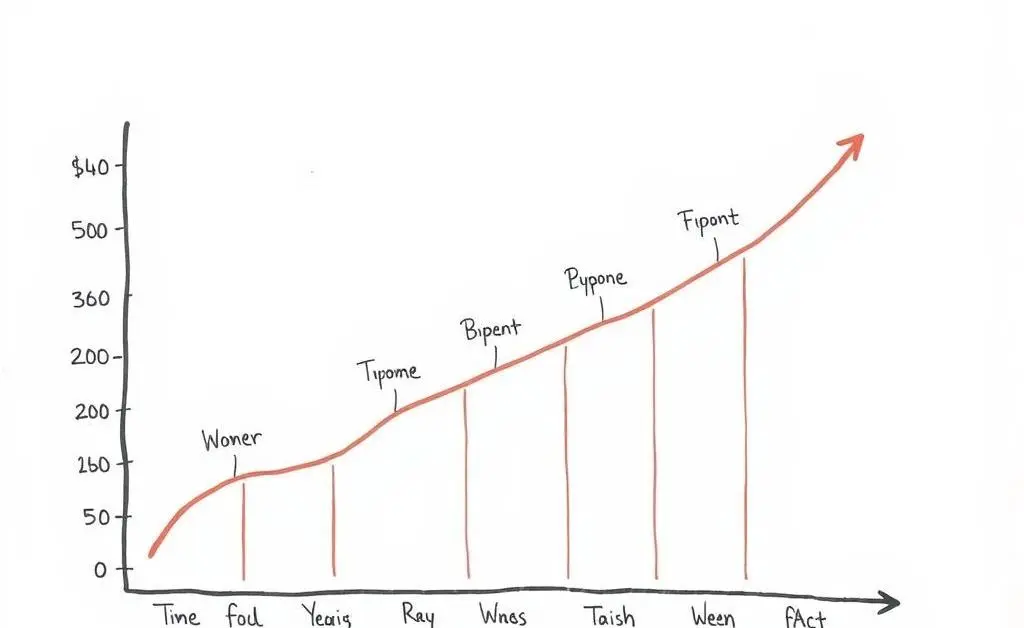

Building Confidence in Investments

Now let’s talk about investments—a word that used to make me sweat! But trust me, once you get a handle on the basics, it starts feeling less like gambling and more like empowerment. Start small, perhaps with a low-cost index fund, often recommended for beginners for their simplicity and broad market exposure.

Simple Tips to Start Investing

- Automate it: Set up automatic transfers to your investment account.

- Diversify: Don’t put all your eggs in one basket—mix it up a little!

Understanding investments and feeling confident in your choices is a journey—start today by educating yourself, maybe by reading a book like "The Intelligent Investor" by Benjamin Graham.

Finding Balance and Joy in Financial Growth

Finally, remember that financial success isn’t just about the numbers. It’s also about feeling secure, making informed decisions, and being able to enjoy your life in the process. Celebrate your small wins and don't get discouraged by the setbacks—they’re all part of the ride.

What’s a small step you’re taking today towards financial freedom and confidence? Share your journey—it might inspire others!