Unlocking Financial Independence: Simple Pen to Paper Techniques

Discover how budgeting with pen and paper can simplify your path to financial independence.

The Surprising Power of Pen and Paper in Financial Planning

Have you ever wondered why people still swear by the humble pen and paper when it comes to budgeting? You might think that in our tech-driven world, old-school methods seem outdated. But there's a deeply personal and powerful connection between the physical act of writing down your financial goals and the achievement of financial independence.

The Mindful Art of Pen and Paper Budgeting

One of the greatest benefits of writing your budget by hand is mindfulness. When you jot things down on paper, you have to slow down, process each expense, and truly engage with your spending habits. This tactile experience is not only therapeutic but also makes your financial goals more tangible.

Imagine a cozy evening at home; you’re sitting at your kitchen table, a warm cup of tea beside you, as you plot out your budget for the month. It's not just a task—it's a moment of introspection. This regular routine helps you keep track of where your money is going and allows you to reassess and adjust your plans actively.

Simplicity Over Complexity

With so many apps and tools out there, it's easy to get overwhelmed. But sometimes, less is more. Here’s why you might want to consider keeping it simple:

- The tactile nature of writing helps improve memory and focus.

- No distractions from notifications or app updates.

- Flexible and adaptable—no tech learning curve involved.

How to Kickstart Your Pen and Paper Budget

Getting started is easier than you think:

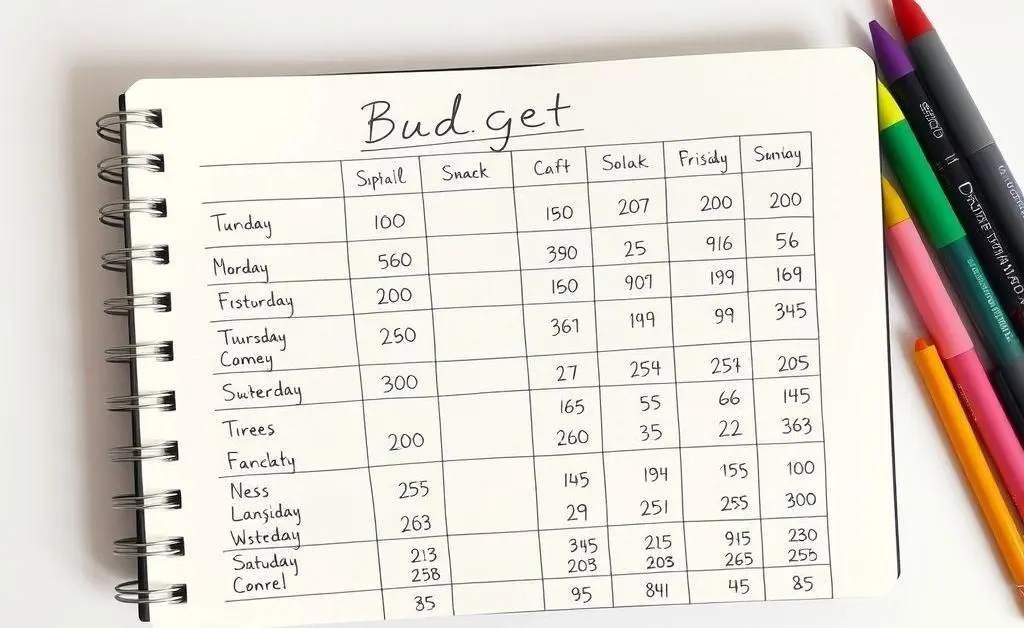

- Gather Your Tools: Choose a notebook and pen you love.

- Set Clear Goals: Write down what you hope to achieve financially.

- Track Regularly: Dedicate time each week to update and revise.

One of my friends, for instance, found that switching back to paper helped them save significantly. They began by simply jotting down daily expenses and soon turned it into a habit. By the end of the year, they were not only reaching their financial goals but enjoying the process as well.

Concluding Thoughts: Your Personal Finance Journey

So, are you ready to harness the power of pen and paper in your financial journey? This simple method might just be the key to bringing clarity and intention to your financial habits. How do you plan to start or continue your journey towards financial independence? I’d love to hear your thoughts or experiences!