Unlocking Financial Independence: Strategies for Young Investors

Discover financial independence strategies for young investors seeking to save smart and invest wisely.

Hey there, have you ever wondered how young investors set themselves up for financial independence? It's not just about earning more; it's about making your money work smarter. Let’s dive into some strategies that can help you achieve financial freedom.

Young And Wanting To Invest? Start Here

If you're in your 20s or 30s, you've got the gift of time on your side. Starting early means more time for your money to grow. The concept of compound interest is your best friend. As Albert Einstein famously said, it’s the eighth wonder of the world!

Understand Your Investment Options

Investing can feel like learning a new language initially. Here’s a quick rundown of some accessible options:

- 401(k) or TSP: Make sure to maximize any employer match - it’s essentially free money.

- Roth IRA: Contributions grow tax-free, and withdrawals in retirement are also tax-free.

- Index Funds: Low cost, diversified, and generally outperform actively managed funds over the long term.

Spend Less, Save More

Remember how your grandma used to say, "A penny saved is a penny earned?" She was onto something. Budgeting doesn’t mean depriving yourself; it’s about being mindful of where your hard-earned dollars go.

Take Alex, a fictional 27-year-old. Alex shifted from spending on every new tech gadget to carefully budgeting, assigning 20% of his income to investments. He learned to live by the 50/30/20 rule:

- 50%: Necessities like rent, groceries, utilities.

- 30%: Wants such as dining out and entertainment.

- 20%: Savings and investments.

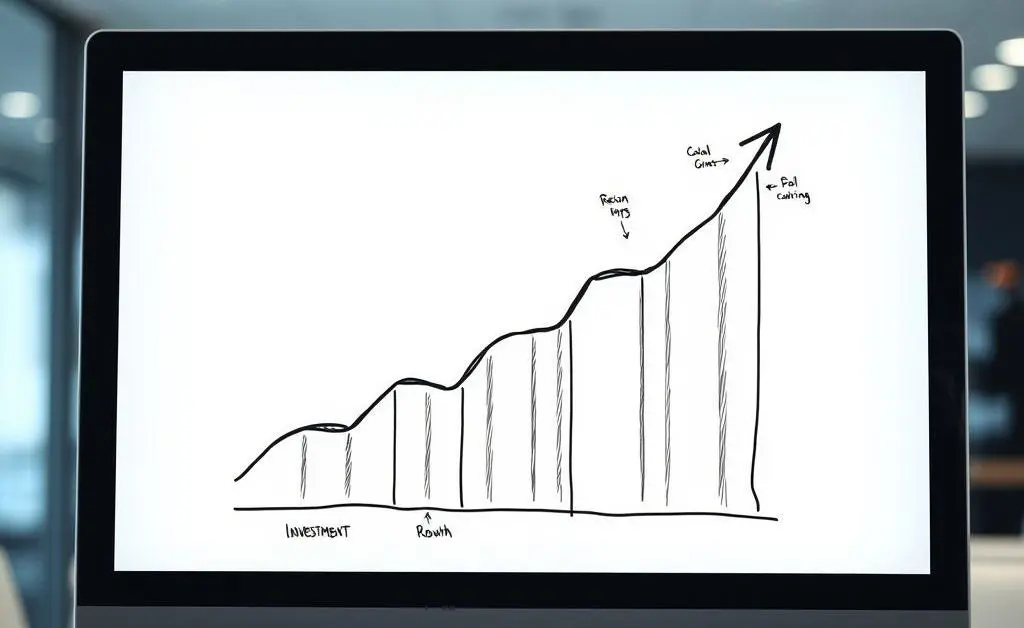

Keep Calm and Invest On

Investing can feel like an emotional rollercoaster. During market ups and downs, it’s easy to panic. But remember, investing is a long-term game. Calm, calculated decisions lead to growth.

Consider hiring a financial advisor if you feel overwhelmed by choices. They can help you develop a balanced portfolio aligned with your risk tolerance and financial goals.

A Final Thought

Ultimately, achieving financial independence isn’t about getting rich quickly. It’s a journey of smart saving, strategic investing, and patient growth. What steps will you take today to unlock your financial future?