Unlocking Financial Success in the Service Industry: A Practical Guide

Navigate financial planning with ease in the service industry.

If you are working in the service industry, you are probably familiar with the challenges of irregular income and unpredictable expenses. When it comes to financial planning, these can seem like significant hurdles, but rest assured, there are ways to turn these challenges into advantages.

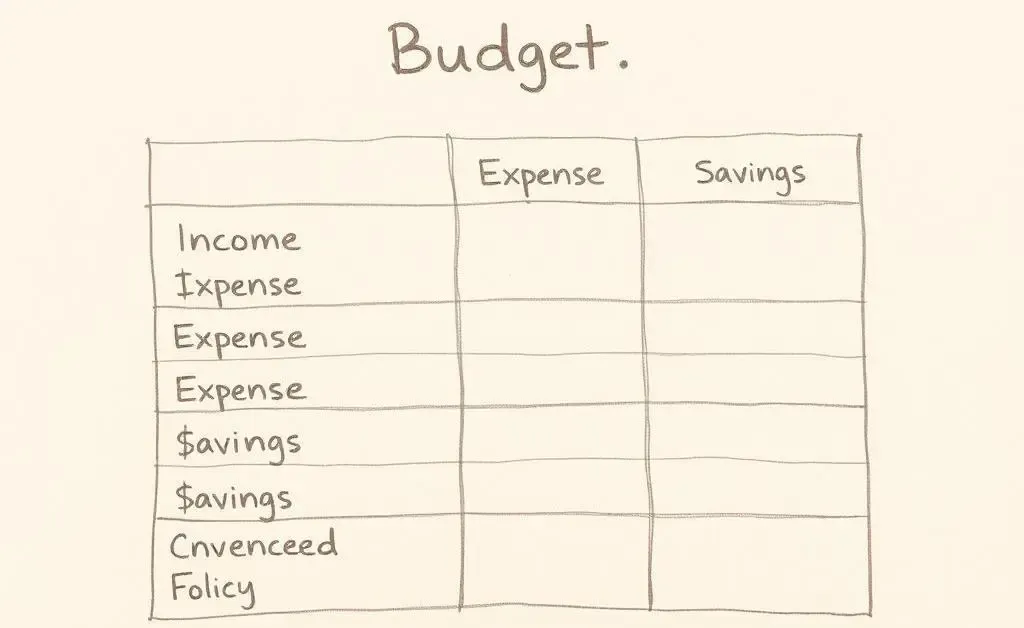

Creating a Flexible Budget

One of the most important steps in managing personal finances is creating a budget that accommodates irregular earnings. Consider categorizing expenses into needs versus wants, and allocate a portion of your income towards savings each month, even if it's a small one. A simple approach is to use the 50/30/20 rule which is:

- 50% of income for necessities

- 30% for discretionary expenses

- 20% for savings

By adopting a flexible budgeting approach, you can manage spendings more effectively without feeling deprived.

Planning for Retirement

In the hustle of daily work, thinking about retirement might seem like a distant concern. However, starting early with a retirement plan can be one of the most rewarding financial decisions. Consider employer-sponsored plans like a 401(k), or explore opening an IRA if you're self-employed. The sooner you start saving, the more you benefit from the magic of compound interest.

Make Retirement a Priority

Even small monthly contributions can grow significantly over time, ensuring that your future self will thank you. Consider speaking with a financial planner to find the best plan tailored to your needs.

Navigating Tax Deductions

Taxes aren't anyone’s favorite subject, but knowing your deductions can make a major difference in what you owe. If you're tipping, commuting, or maintaining a uniform for a job, you may be eligible for deductions. Keeping meticulous records throughout the year can ease the stress come tax season. Don’t underestimate the value of a qualified tax advisor to guide you through the process.

As someone who has juggled similar financial challenges, I know how overwhelming it can seem. Remember, every small step you take today lays a foundation for stability tomorrow. What strategies have you found helpful in managing your finances in a fluctuating job environment?