Unlocking the Benefits of Usage-Based Car Insurance

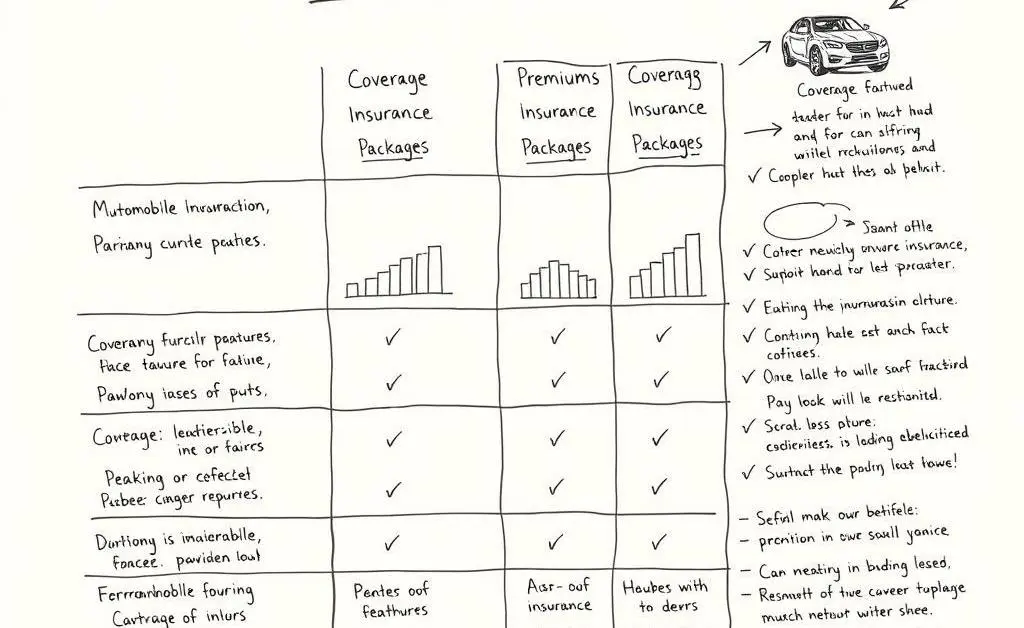

Discover the perks of usage-based car insurance and how it can save you money on premiums.

Have you ever wondered if there was a way to cut down on those pesky car insurance premiums? If you've ever felt like you pay too much despite being a conscientious driver, you're not alone. Usage-based car insurance could be your ticket to savings!

What is Usage-Based Car Insurance?

In simple terms, usage-based car insurance, often abbreviated as UBI, is a modern twist on traditional coverage. It leverages smart technology—like your car's onboard computer and a mobile app—to track your driving habits and determine your premium rates. The better you drive, the more you can save!

- Monitors driving habits like speed, braking, and acceleration.

- Customizes premiums based on your unique profile.

- Rewards safe drivers with lower costs.

The Personal Story

Meet Sarah, a cautious driver and a mother of two. She was thrilled when she discovered usage-based insurance. By installing a tracking app on her phone, Sarah received feedback on her driving style. Surprisingly, she found that she occasionally sped on downhill stretches without realizing it. With this knowledge, she adjusted her habits and watched her premiums dip over the months. Imagine her delight when she received a 15% discount!

How to Get Started

Ready to switch to usage-based insurance? Here's what you need to do:

- Research insurance providers that offer UBI programs, which can vary widely based on location.

- Download the necessary smartphone app and connect it to your vehicle's system.

- Drive mindfully and check feedback to adjust habits.

Addressing Privacy Concerns

It's normal to worry about privacy when sharing driving data. Rest assured, most insurers use high-standard encryption and store data safely. However, always read the terms and conditions and understand how your information will be used.

Is Usage-Based Insurance Right for You?

While usage-based insurance is a boon for some, it's not for everyone. It suits drivers who:

- Drive less frequently than average.

- Have safe driving habits.

- Want more control over their insurance costs.

So, what’s your driving style? Do you think usage-based insurance could benefit you? Remember, it's not just about saving money—it's about being conscious of how we drive and making safer roads for everyone.

Would you consider switching to usage-based insurance if you could track your driving habits and receive discounts?