Unlocking the Secret to Dividend Investing: A Friendly Guide

Learn how dividend investing can grow wealth with practical tips and insights.

Have you ever found yourself staring at your savings account and thinking there's got to be a better way? You're not alone in this journey towards financial growth and independence. Let's take a peek behind the curtain of dividend investing – a steady approach to nurturing your finances.

What are Dividend Stocks?

Imagine, for a moment, owning a slice of a company and getting paid for it in the form of dividends. Dividend stocks are like the gift that keeps on giving. They offer an additional layer of income through periodic payouts, all while you hold onto your investment. It's like a cherished old friend who hands you a little something extra just for being there.

Why Consider Dividend Investing?

Choosing dividend stocks can be a smart move for several reasons:

- Steady Income: Provides regular payouts that can be reinvested or used as income.

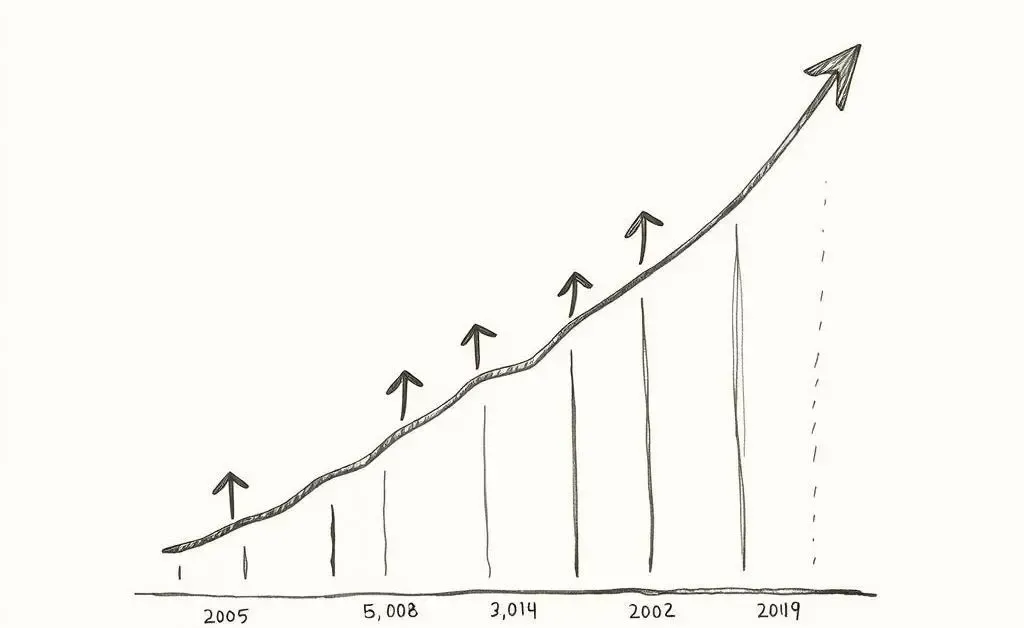

- Potential for Long-Term Growth: Stocks from established companies often show resilience and growth over time.

- Tax Efficiency: Dividends can be more tax-efficient compared to other forms of income.

Getting Started: A Relatable Anecdote

Let's take Sally, a curious investor by nature. When she started, Sally felt overwhelmed by terms like yield and payout ratios. However, the lightbulb moment came during a cozy winter weekend with a warm cup of cocoa. She realized that by investing in companies she already believed in, she was not only a customer but a stakeholder. Fast forward a few years, Sally now enjoys watching her small monthly checks add up – it's like a subtle applause to her wise choices.

Creating Your Dividend Strategy

Begin by researching companies with a strong history of dividend payouts. Diversification is your trusty shield, so consider spreading your investments across different sectors.

Many also opt for a dividend reinvestment plan (DRIP), where their dividends automatically purchase more shares. It's like a little snowball that rolls itself into something larger.

Closing Thoughts

Dipping your toes into the waters of dividend investing can be both rewarding and reassuring. Like any journey, it requires some research, patience, and a sprinkle of curiosity. How will you begin to incorporate dividend investments into your finances? Let the conversation continue in the comments below!