Unlocking the Secrets of Smart Home Equity Management

Discover how to wisely use home equity for financial stability and growth.

Have you ever felt like your home's equity is a hidden treasure chest, waiting to be unlocked, but you're just not sure which key to use? You're not alone. Many homeowners ponder the best ways to leverage their home equity for more financial freedom.

Understanding Home Equity

Home equity is essentially your house's market value minus any remaining mortgage you owe. It can open doors to opportunities or, if mishandled, lead to pitfalls.

The Many Faces of Home Equity Utilization

There are several avenues to explore when tapping into your home equity:

- Home Improvement: Investing in renovations can boost your property value.

- Debt Consolidation: Using equity to pay off high-interest debts might reduce your overall payment burden.

- Investment: Some use their equity to invest in the stock market or a new business venture.

- Emergency Fund: Having a safety net can provide peace of mind during tough times.

Each option has its own risks and rewards.

Real Benefits: A Real-Life Example

Imagine this. Jane, a smart and frugal homeowner, decided to remodel her outdated kitchen using home equity. Not only did it increase her house value, but it also made her daily life more enjoyable, and her property more appealing to potential buyers. By making informed decisions, Jane could enhance her investments while enjoying immediate benefits.

Interestingly, Investopedia highlights the importance of understanding costs and avoiding common mistakes when using home equity loans.

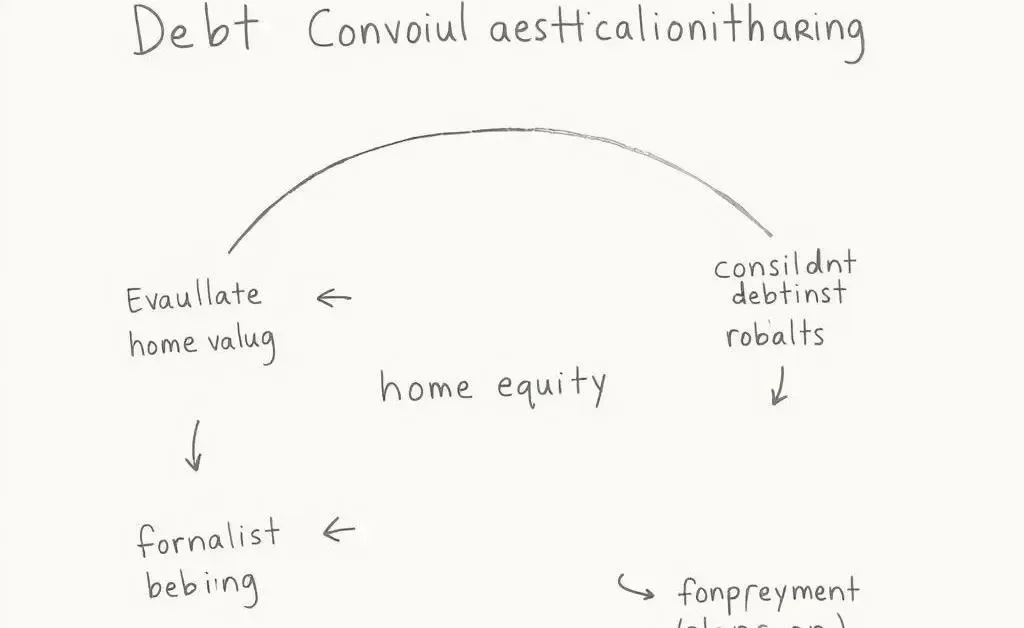

Debt Consolidation: A Path to Financial Clarity

Combining multiple debts into a single payment often at a lower interest rate can make financial management simpler. Plus, using home equity loans for this can be a smart move, as long as you avoid accumulating more debt in the process.

Final Thoughts: Your Unique Financial Landscape

Your home equity offers you a choice. It's crucial to weigh options, consider your financial goals, and understand the potential outcomes. Whether you're aiming for a kitchen facelift or consolidating debt, your approach should align with both your immediate needs and long-term objectives.

So, what journey will you embark upon with your home equity? Do any particular strategies resonate with your financial goals?