Unlocking the Smartest Ways to Use Home Equity for Financial Goals

Discover savvy strategies to leverage home equity and reach your financial aspirations.

Ever pondered about cracking the code on home equity to supercharge your financial objectives? Home equity, the market value of your property minus any debts, can be a powerful ally if wielded judiciously.

What Exactly Is Home Equity?

Home equity is essentially the portion of your home you truly 'own.' Every mortgage payment you make is a step towards increasing this ownership. Let's face it, watching that number grow is almost as satisfying as finding a forgotten $20 bill in your pocket.

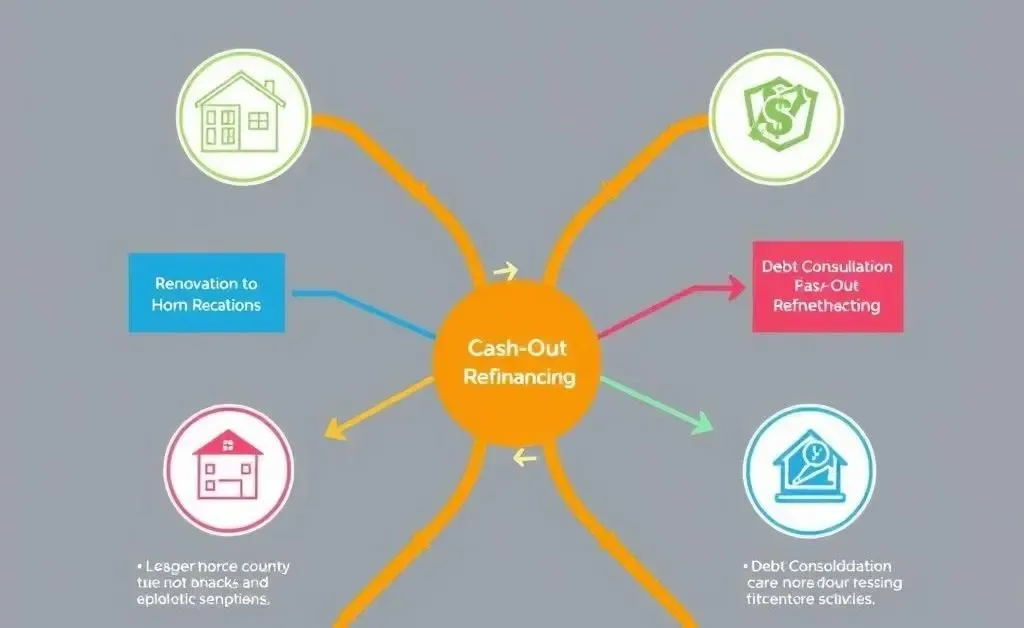

Top Strategies for Leveraging Home Equity

While home equity can be used in myriad ways, not all options are created equal. Here are several smart strategies:

- Home Improvements: Invest back into your property. A kitchen facelift might pay off in resale value!

- Debt Consolidation: Swap high-interest debts for a lower-rate home equity loan.

- Investment Opportunities: Think of expanding your financial horizons by investing in diverse assets.

- Emergency Fund: Create a rainy-day fund with home equity line of credit (HELOC).

These approaches can help elevate your financial status and make life a tad less stressful.

A Relatable Story of Smart Home Equity Use

Imagine Chris, a budding entrepreneur, who used home equity to fuel his startup dreams. The leap paid off, illustrating a well-researched risk. Of course, Chris did his homework first — evaluating risks and discussing with a financial advisor. Ah, the sweet taste of calculated risks!

The Risks to Watch Out For

Yes, downsides exist. Tapping into home equity irresponsibly can lead to financial pitfalls. Missing payments could jeopardize your living situation. Always read the small print and maybe enlist a finance-savvy friend.

It's crucial to evaluate your overall financial status. This includes consulting experts or using handy financial tools such as this comprehensive guide on home equity.

Conclusion: Your Next Move?

When employed prudently, home equity can act as your financial toolbox equipped to renovate your fiscal future. What's your next financial move going to be? Have you considered how your property might play a role in that journey?