Unlocking the Value of Forgotten Savings: Revisiting Old Bonds

Discover how old savings bonds can grow over time and the simple steps to cash them in today.

Have you ever cleaned out an attic or stumbled upon a dusty box, only to find a little piece of your financial history in the form of old savings bonds? It might just be the lucky discovery you didn't know you were looking for. Savings bonds, especially those issued by the U.S. government, were a popular gift and investment option in the past. People often tucked them away for a rainy day or as a long-term investment, sometimes completely forgetting about them.

Why You Should Check for Old Savings Bonds

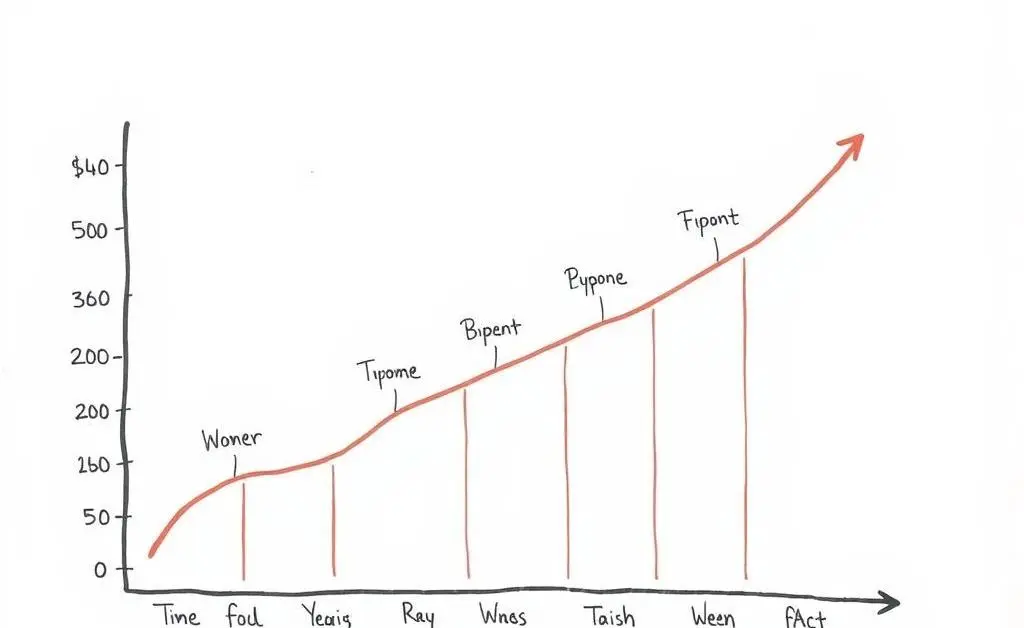

You might wonder whether it's worth the effort to check if you have any bonds stashed away. Well, here's the exciting part: over time, the value of these bonds can increase significantly. While they may not make you a millionaire overnight, finding a $25 bond from decades ago could mean you have a higher value on your hands today.

Are My Old Bonds Still Worth Anything?

The next question is whether your bonds have matured and if so, whether they're still accruing interest. U.S. savings bonds typically have a maturity period of 20 to 30 years, with the interest stopping once they reach full maturity. Even if your bond has matured, its current value might surprise you.

How to Cash In Your Old Bonds

Cashing in your bonds is quite straightforward. You can take them to your local bank, or if they're digital, you can redeem them online through the TreasuryDirect website. If your bonds are paper, make sure to bring proper identification, like your driver's license, for verification purposes.

Investing Your Bond Windfall Wisely

Once you've cashed in your bonds, the next challenge is deciding how to use that newfound cash in the wisest way possible. This decision should align with your current financial goals—be it debt reduction, boosting an emergency fund, or investing for the future. Consider consulting a financial advisor if you’re uncertain about your options.

Take the First Step Toward Your Financial Goals

Rediscovering those old savings bonds could be your first step toward achieving specific financial goals. They serve as a great reminder that planning for the future, no matter how small the steps may be, can lead to significant payoffs over time. So, roll up your sleeves and sift through those old papers—you might find more than just nostalgia!

Have you recently discovered old savings bonds? How did you decide to use the funds? I'd love to hear your thoughts and tips in the comments below!