What Happens if a Friend Borrows Your Car and Crashes It?

Discover how insurance works if a friend crashes your car and learn ways to protect yourself.

Oh boy, you’ve lent your car to a friend, and now you're anxiously staring at your phone because they've just called to say there’s been an accident. You might be wondering, 'What happens next?', 'What does my insurance cover?', and 'How do I handle this without souring our friendship?' Here’s a guide to navigating such tricky situations.

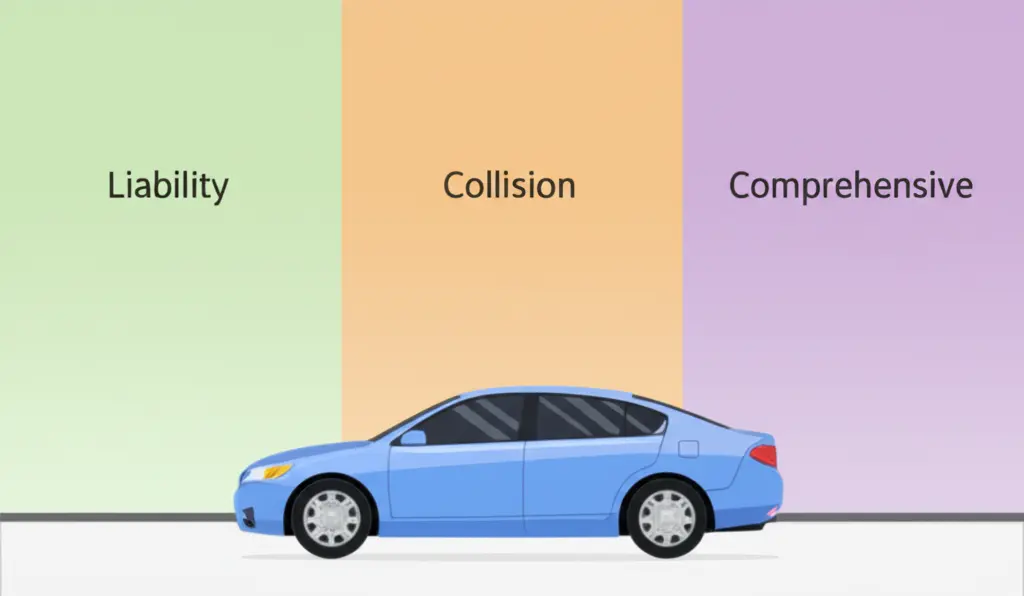

Understanding Insurance Coverage

First things first, let's talk about car insurance. Typically, car insurance follows the car, not the driver. This means if someone else is driving your car and gets into an accident, your insurance is usually the one that kicks in first. Of course, policies differ, and it's always a good idea to read the fine print or speak with your agent to know what's covered.

Who is Covered Under Your Policy?

Your car insurance policy likely includes provisions for permissive use. This means that if you've given someone permission to drive your car, insurance will usually cover accidents they are involved in. However, exceptions apply, especially if the driver lives with you and isn't listed on the policy. It’s always wise to check with your insurer to understand specifics like this.

Steps to Take After an Accident

Okay, deep breath. Accidents happen, and how you handle it can make all the difference.

- Ensure Safety: Make sure everyone is safe and any necessary medical assistance is sought.

- Document the Scene: Take photos of the accident scene, vehicle damage, and any involved parties. This documentation will be crucial later.

- Contact Your Insurance Company: Notify your insurance provider as soon as possible to start the claims process.

- Gather Information: Collect names, contact details, and insurance information from all parties involved. This can streamline the claims process.

Keeping Friendships Intact

Navigating an accident with a friend at the wheel can be tricky. Here are my two cents on how to handle it:

- Open Communication: Be honest and transparent about expectations for financial responsibility and insurance processes.

- Stay Calm: Accidents are stressful. Keeping a level head will ensure you handle the situation smoothly.

- Be Prepared: Consider a pre-driving chat when lending your car, covering who will handle what in case of damage.

There's no denying these situations can test your nerves and your friendships. Still, with a plan and clear communication, they don't have to escalate into bigger issues.

Conclusion: Lessons from the Unexpected

When lending out your car, always be aware of your insurance policy details and communicate clearly with the borrower. What have you learned about car coverage in nerve-wracking situations like this? Drop your thoughts in the comments!