What Should You Do with Your Old 401(k)? Smart Tips for Recent Job Changers

Learn practical strategies to manage your old 401(k) after switching jobs effectively.

Have you recently changed jobs and are left wondering what to do with your old 401(k)? You're definitely not alone. Leaving an employer comes with many adjustments, and figuring out the best move for your 401(k) can feel like deciphering a complex puzzle.

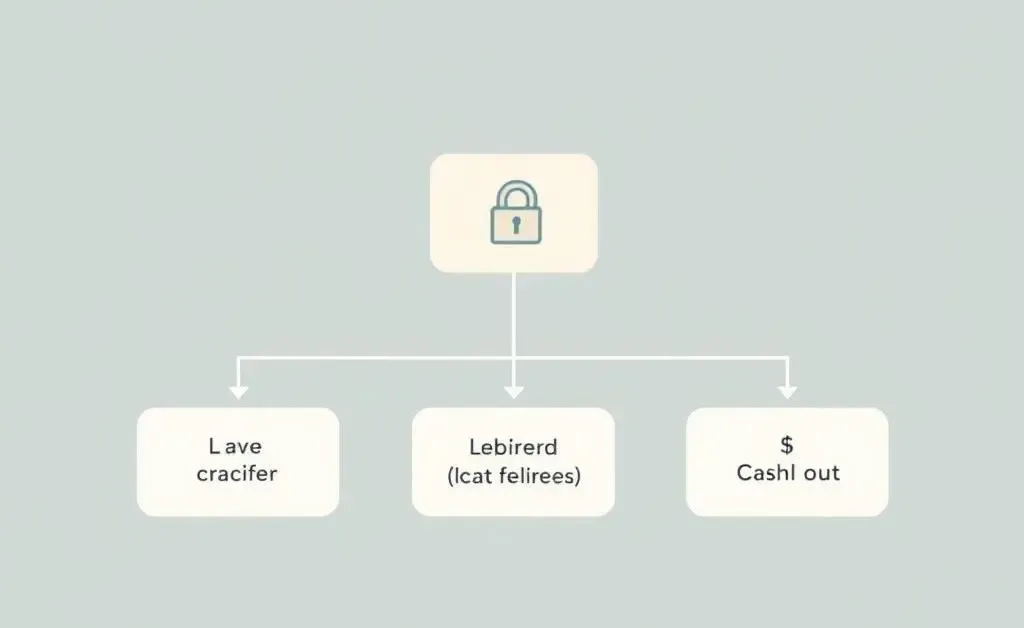

Assess Your Options: What Can You Do With That 401(k)?

When it comes to your old 401(k), you essentially have four choices. Each comes with its own advantages and drawbacks, so let's break them down:

- Leave it with your old employer: This can be the simplest option, but note that you'll have limited control and may face higher fees.

- Roll it over into your new employer’s plan: This keeps your retirement savings consolidated, but verify if your new plan supports rollovers and compare expense ratios.

- Roll it over into an Individual Retirement Account (IRA): Unlock a wider range of investment options, though it may lack the loan option your 401(k) might offer.

- Cash it out: This is rarely recommended due to immediate taxes and penalties, and the potential long-term impact on your retirement savings.

Evaluating Each Choice

It often helps to think of this decision as a choose-your-own-adventure story. What's your risk tolerance? Do you value flexibility or simplicity? Understanding your financial goals is crucial—as one anecdote goes, "When Jamie left their tech job, they were tempted to cash out and buy the new car they'd been eyeing. But after weighing the options, they decided to roll their 401(k) into an IRA. Now they're grateful to have a diverse investment portfolio growing steadily!"

The Value of a Consultative Approach

Chatting with a financial advisor can offer personalized insight into this decision. If meeting an advisor isn't feasible, take advantage of online platforms and tools that can guide your decision through simulations and tailored suggestions. This guide can help you find some of the best online resources for financial advising.

Rolling Over to an IRA: A Closer Look

Choosing an IRA gives you more investment choices, such as low-cost index funds or even cryptocurrencies if you're feeling adventurous. But remember, there's also the responsibility of managing your investments wisely, or it might become the financial equivalent of owning a puppy—it sounded great at first, but without proper attention, it can get messy!

The Takeaway

Your past job's 401(k) is a vital resource, purchased with your hard-earned dollars. Handle it with the care it deserves, to support a fruitful future journey. Share in the comments—how have you managed your old 401(k) and where did it lead you?