What To Do With $60K When You're Between Jobs

Smart ways to grow $60K when you're not employed.

So, What To Do with $60K When You're Out of a Job?

First, breathe. Having a cushion like $60,000 is an excellent start, especially when you're not employed. Let's explore some smart steps you can take to manage this money wisely, ensuring it works for you now and sets you up for future success.

Building an Emergency Fund

Before we dive into any investments, it's crucial to establish an emergency fund. Conventional advice suggests covering three to six months' worth of expenses. Consider stashing some of your money — let’s say around $20K — into a high-yield savings account or a money market account. This ensures easy access in case unforeseen expenses arise.

Exploring Smart Investment Options

Once your emergency fund is squared away, you can consider investing the remaining amount. The stock market might sound thrilling, but it's crucial to align investments with your risk tolerance:

- Stocks and ETFs: Ideal if you're comfortable with risk. They offer higher potential returns but come with volatility.

- Bonds: These are generally more stable but offer lower returns compared to stocks.

- Robo-advisors: These provide diversified portfolios with varying risk levels, making them great for beginners.

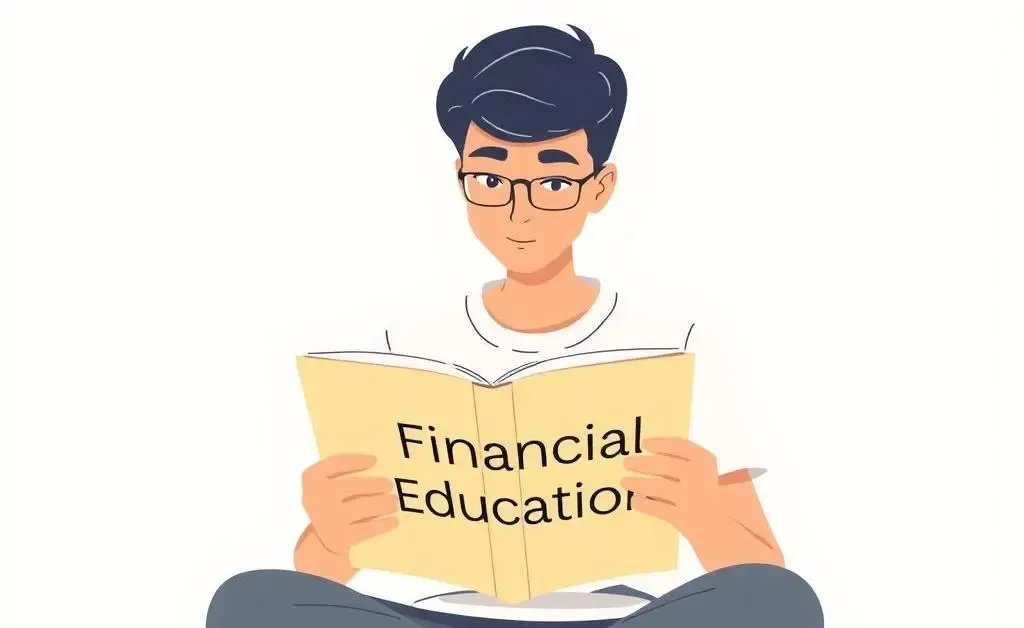

Investing in Yourself

Another underrated way to use your money is by investing in yourself. Consider upskilling or learning new things – this can be invaluable. Whether it's enrolling in a course or attending workshops, enhancing your skills can make you more appealing to potential employers and open doors to new opportunities.

Exploring Short-term Opportunities

If you want to keep things flexible and aren’t ready for long-term commitments, think about short-term bonds or certificates of deposit (CDs). These can provide modest returns and ensure your funds aren’t locked away long-term.

Takeaway: Begin with a Plan

Having $60K is a fantastic foundation when navigating unemployment. Setting up an emergency fund, considering investments that match your risk appetite, and investing in your skills can provide security and growth simultaneously. What would you consider doing with your savings if you were in a similar situation? Let's explore this financial journey together!