Why Are Large Pension Funds Reducing Exposure to US Stocks?

Discover why large pension funds are cutting US stock exposure and what it means for individual investors.

Have you heard about the trend of large pension funds reducing their exposure to US stocks? If you're like me, this might have caught your attention and raised some questions. After all, US stocks have typically been a cornerstone of many investment portfolios. But what’s behind this shift, and should we be doing anything about it?

What's Driving Pension Funds Away from US Stocks?

It's not as dire as it sounds at first. Large pension funds are not completely abandoning US stocks but are simply reallocating their assets. There are a few reasons for this:

- Market Volatility: The US stock market has been particularly volatile, making pension funds wary. They're seeking more stable returns to meet their future payout obligations.

- Valuation Concerns: Some investors feel that US stocks are overvalued and may not deliver the same returns going forward.

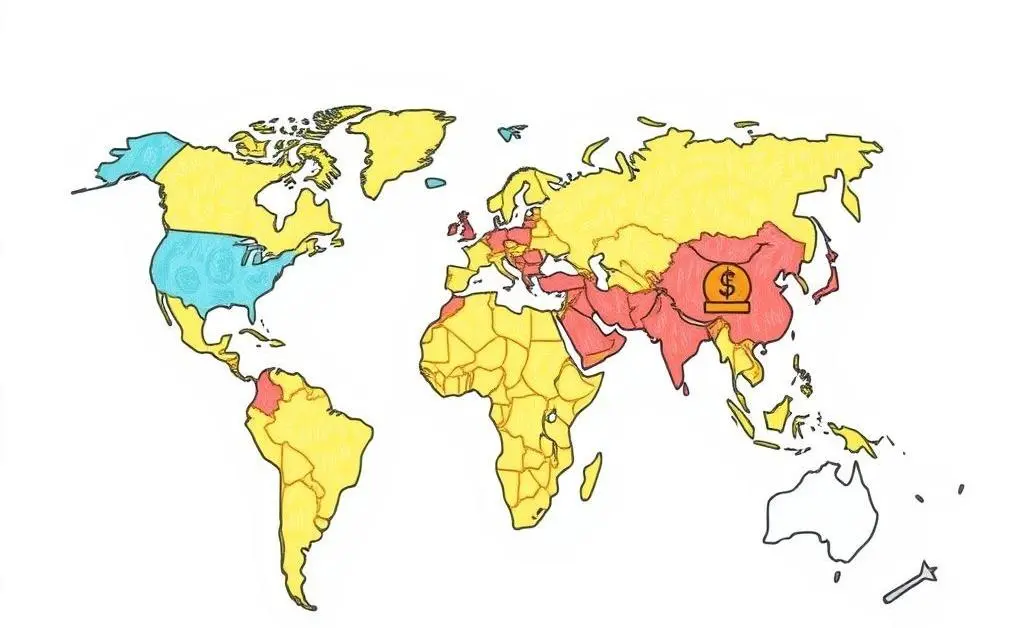

- Global Diversification: By reducing US stock exposure, pension funds have the opportunity to diversify globally, potentially reducing risk and improving returns.

What Does This Mean for Individual Investors?

You might be wondering how this information impacts your own investment strategy. Here are a few insights:

- Review Your Diversification: Just like pension funds, consider whether your portfolio is overly reliant on any single market.

- Global Opportunities: Look into investment opportunities outside the US for potential growth and diversification.

- Stay Informed: Keep an eye on global economic trends and adjust your portfolio as needed.

How to Diversify Effectively

Creating a well-rounded portfolio isn't just for the big players; you can adopt similar strategies:

- Mix Asset Classes: Include a range of asset classes like bonds, real estate, and commodities in addition to stocks.

- Explore Emerging Markets: Consider investments in emerging markets for higher growth potential alongside higher risk.

- Target Specific Sectors: Diversify into various sectors that you believe in, such as technology or healthcare.

Conclusion: Making Informed Investment Choices

While it might be unsettling to hear about large shifts in investment strategies, keep in mind that change can be a good thing. Large pension funds are just taking a more balanced approach, and perhaps that’s a lesson we can all benefit from. What steps are you taking to ensure your portfolio is well-diversified? Share your thoughts and let’s discuss!