Why Did My Credit Score Drop After I Paid Off Debt?

Exploring why your credit score might dip after paying off debt.

Have you recently celebrated paying off a debt, only to see your credit score take a surprising dip? If so, you’re not alone. This curious pattern might seem like a cruel joke, but let’s break it down and uncover why your credit score might temporarily drop after crossing that debt off your list.

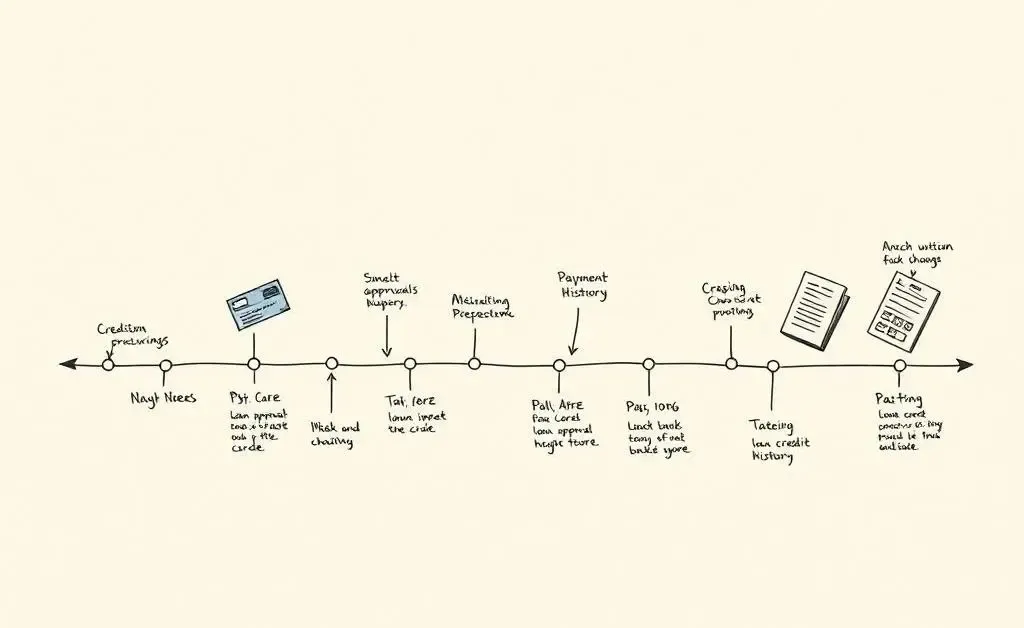

Understanding the Mechanisms of a Credit Score

Your credit score is like a complex recipe, where several components blend together. Primarily, it boils down to these factors:

- Payment History

- Credit Utilization Ratio

- Length of Credit History

- Credit Mix

- New Credit

Knowing these components helps us demystify the puzzling drop in your score.

Payment History: The Kingpin of Your Score

While it doesn’t directly answer our question, your payment history still reigns supreme, making up about 35% of your score. Consistently paying bills on time bolsters your creditworthiness.

Credit Utilization Ratio: Too High or Too Low?

This factor accounts for 30% of your score, measuring how much of your available credit you’re using. Interestingly, closing a credit account could spike your utilization ratio if it significantly reduces your available credit.

For example, imagine you have $10,000 of available credit, and you pay off $3,000. If that $3,000 was your limit, the closure can suddenly change your utilization from 30% to 50% if the remaining credit is $3,500.

The Length of Your Credit History

Your credit history’s longevity contributes 15% to your score. Closing an account might affect this if it’s one of your older accounts, thus shortening the average age of your accounts.

What Can You Do About It?

Understanding these factors helps you make informed decisions. Here are a few practical steps:

- Check Your Report: Monitor your credit reports to ensure accuracy.

- Plan for Impact: Be strategic in paying off debt, considering how old accounts affect your score.

- Explore Options: If possible, keep older accounts open and occasionally active to maintain credit length and utilization.

In a nutshell, this temporary dip usually isn’t a cause for alarm. Continue showcasing positive financial habits, and over time, you’ll likely see your score bounce back or even rise beyond its previous peaks.

Final Thoughts

Your credit score is more than just a number; it’s a reflection of your financial journey. Ever had your credit score drop for an unexpected reason? How did you handle it? Let us know in the comments below!