Why Did My Credit Score Drop After Paying Off a Loan? Understanding the Surprise Dip

Uncover why credit scores may drop after paying off a loan. It's not always logical, but here's why it happens!

You’ve finally paid off that pesky loan. Congratulations! But wait—why did your credit score take a hit right after you paid it off? It’s not just you; many people have noticed this annoying phenomenon, and there’s a perfectly good (albeit a bit complex) explanation behind it.

Understanding Your Credit Mix and Length

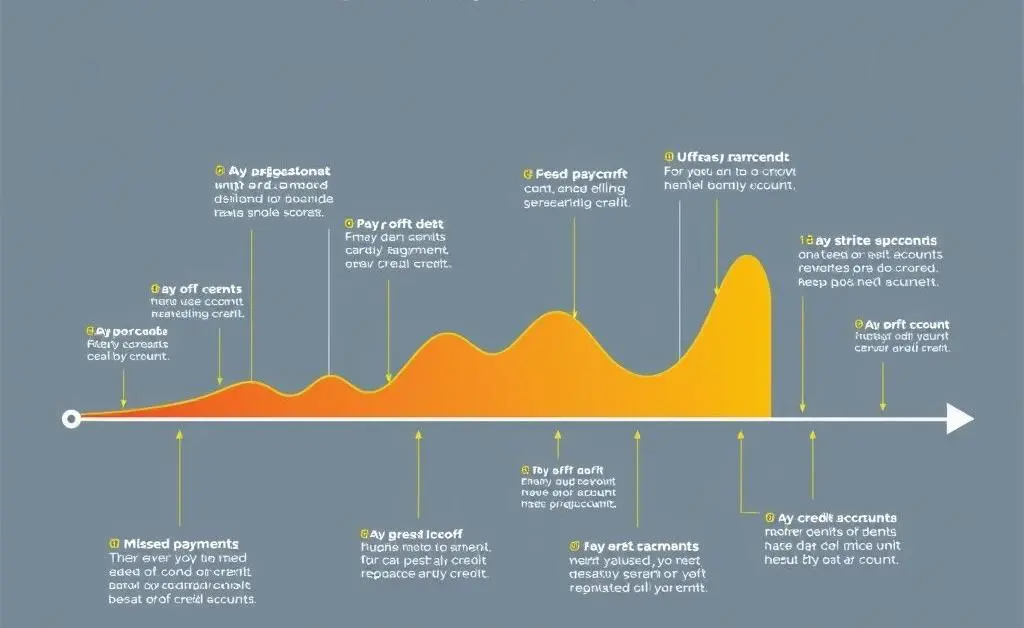

First off, the primary keyword here—your credit score—is determined by a mix of factors. One common reason for a dip is the impact on your credit mix. Your score benefits from having a variety of credit types, like credit cards, mortgages, and installment loans. When you pay off a loan, you might lose that diversity in your credit portfolio.

Another factor is the length of credit history. Paid-off loans often become closed accounts and, over time, stop contributing positively to the length of your credit history. It’s like losing an old friend from your group—the dynamic shifts!

Don’t Worry; It’s a Temporary Dip

Before you hit the panic button, understand that this dip is usually temporary. Your score should stabilize once your credit history adjusts. In fact, being debt-free actually boosts your financial status long-term. Here’s a silver lining: depending on the context, that dip might mean opportunities for new, more favorable credit offers.

How to Maintain a Healthy Credit Score

Here are a few tips to keep your score healthy while navigating these changes:

- Don’t close old credit card accounts: It may be tempting, but these accounts contribute to your credit history length.

- Keep an eye on credit utilization: This ratio between your current credit card balances and your credit limits should stay below 30%.

- Diversify when possible: Consider maintaining different credit types if you can manage them responsibly.

Takeaway

So, next time your credit score baffles you post-loan repayment, remember it’s not a reflection of bad financial management. Celebrate being debt-free, keep an eye on your diverse financial habits, and you should see your score reflect your efforts soon. How do you plan to celebrate becoming debt-free?