Why Did My Credit Score Drop After Paying Off Debt?

Explore why paying off debt might lower your credit score temporarily.

Why Did My Credit Score Drop After Paying Off Debt?

Ever wondered why your credit score takes a dip after you finally pay off that lingering debt? You'd think getting rid of debt would be a win for your financial health, right? Well, it definitely is—but it can also lead to some surprising side effects.

Understanding the Credit Score Puzzle

Your credit score is a bit like a mysterious puzzle. It’s made up of various pieces, and when you change one piece, the whole picture might shift in unexpected ways. The logic behind this is grounded in the multiple factors that comprise your score, such as credit mix, length of credit history, and utilization rate.

The Impact of Paying Off Debt

Here's a simple breakdown of why your credit score might dip when you pay off debt:

- Account Closure: Paying off and closing an account reduces your overall available credit.

- Credit Utilization: If you have few accounts, losing one increases your credit utilization ratio automatically.

- Age of Credit History: Closing an older account reduces the average age of your credit accounts.

An Anecdote on Paying Off Debt

Imagine Sam, a diligent worker and financial enthusiast who just paid off their two-year car loan. Sam felt on top of the world, only to be puzzled and distressed to find their credit score had taken a nosedive.

Sam’s reaction is common. While the dip may feel like a penalty, it’s generally temporary. Eventually, the benefits of a zero loan balance shine through as Sam's score stabilizes and rises, reflecting improved credit health.

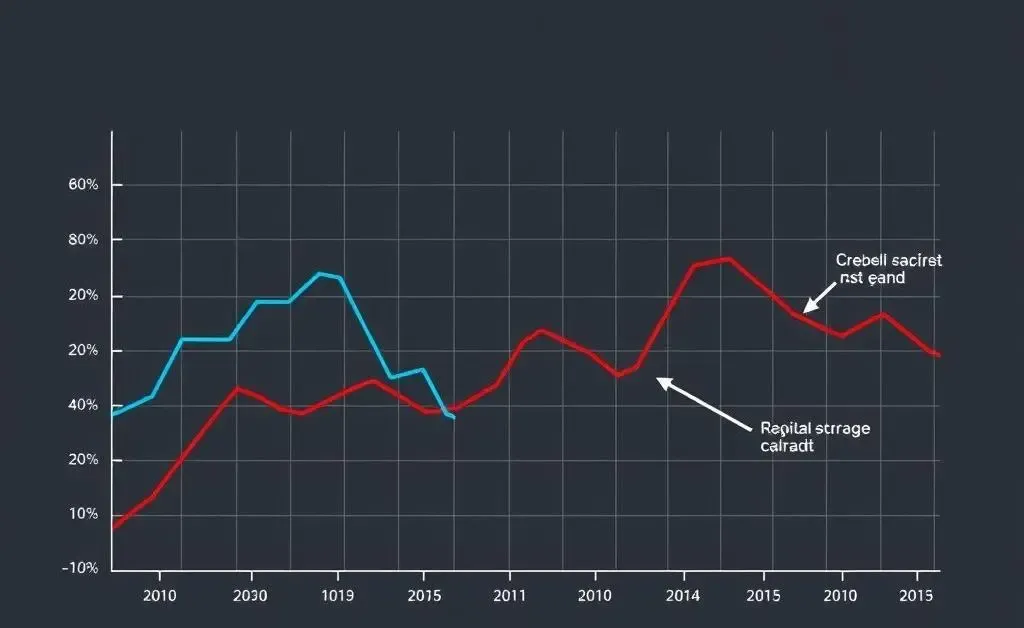

Riding the Credit Score Waves

It’s crucial to understand that credit score fluctuations are part of managing finances—think of it as a financial life cycle! The key is staying proactive:

- Occasionally check your credit report for any errors or changes.

- Maintain diverse types of credit to keep your credit mix healthy.

- Stay patient. The dip is likely temporary before a steady rise.

Moving Forward

Remember, while a dip in your credit score after paying off debt can feel frustrating, it’s usually just a temporary blip. Keeping an eye on your score, understanding the factors at play, and maintaining good credit habits can smooth out the bumps on the road to financial wellness.

Have you ever experienced an unexpected drop in your credit score? How did you handle it?