Why Have Home Insurance Prices Risen? Exploring the Reasons and What You Can Do

Learn why home insurance costs are climbing and how you can manage and reduce expenses effectively.

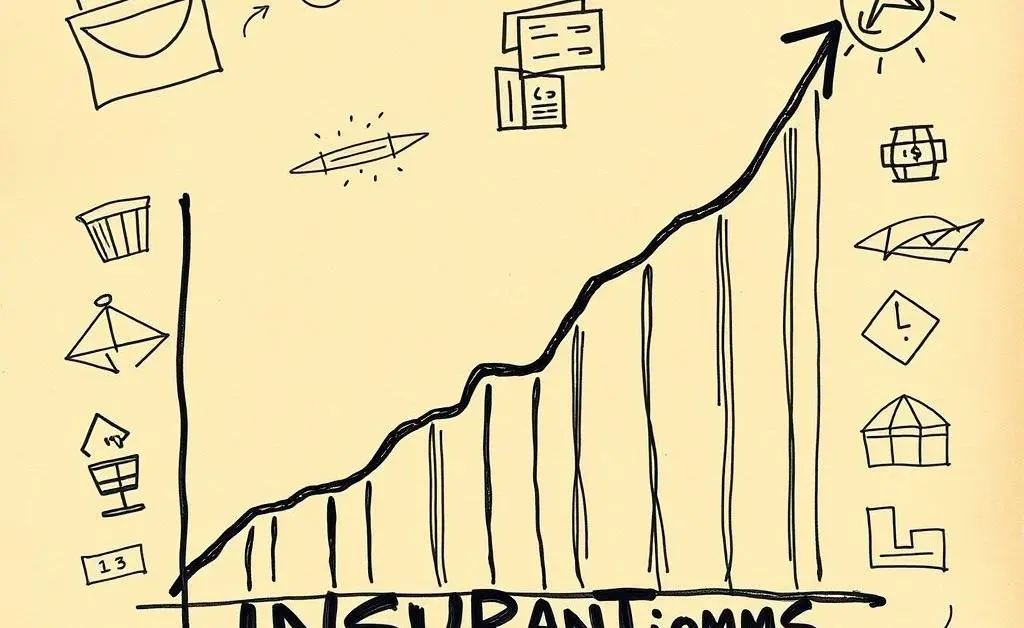

Why Is Your Home Insurance Premium Rising?

If you’ve noticed your home insurance premiums rising recently, you’re definitely not alone. In the first few paragraphs, I’ll explore some of the common reasons and trends contributing to these hikes.

Natural Disasters and Climate Change

One of the biggest factors driving up costs is the increase in natural disasters. Events like hurricanes, floods, and wildfires are becoming more frequent and severe, which puts tremendous pressure on insurers. They adjust premiums to account for higher potential payouts.

Rising Repair Costs

The cost of building materials and labor has also risen sharply. If your home were to suffer damage, it would cost the insurer more to repair or rebuild it today than in past years. These increased costs are reflected in your insurance premium.

Insurance Industry Adjustments

Insurance companies are businesses, and like any business, they adjust to maintain profitability. They might reassess risk calculations based on several factors, from current market conditions to changes in state regulations, leading to revised premiums.

What Can You Do About Rising Insurance Costs?

Despite these increases, there are ways you can manage and potentially lower your home insurance costs.

Review and Adjust Coverage

First, take a close look at your policy. Are there areas where you have excess coverage that you could reduce? Make sure your policy reflects your current needs rather than what was needed when you first set up the plan.

Shop Around Regularly

Don't just renew automatically each year. Spend some time comparing quotes from different providers. You may find better rates by taking a little time to shop around.

Maintain Good Home Security

Installing security systems and smoke alarms can not only protect your home but may also qualify you for discounts on your insurance. Check with your insurer to see what upgrades might be rewarded.

Conclusion

While rising insurance premiums can be frustrating, understanding the reasons behind the hikes can help you make more informed decisions. By reviewing your current policy, shopping around, and implementing ways to secure your home, you can potentially reduce your costs. How do you plan to tackle your insurance costs in the coming year?