Why Long-Term Investments Matter More Than You Think

Explore why returns matter more over time and learn how to invest wisely for the future.

Have you ever heard the saying, "It's not about timing the market, but time in the market"? It's a catchy phrase, but what does it really mean? If you've ever wondered how investment returns can transform over time, you're in the right place. Let's dive into why patience is truly a virtue when it comes to investing.

Why Focus on Long-Term Investments?

First off, let's address the elephant in the room: market volatility. Yes, stock prices can be unpredictable. But focusing on long-term investments can help you ride out the bumps and emerges stronger on the other side.

Here's a relatable story: Imagine Sarah, a diligent investor who started buying stocks at 25. She invested $200 a month without fail. By the time she reached 60, her portfolio grew significantly because she maintained her focus on the big picture, not the daily fluctuations.

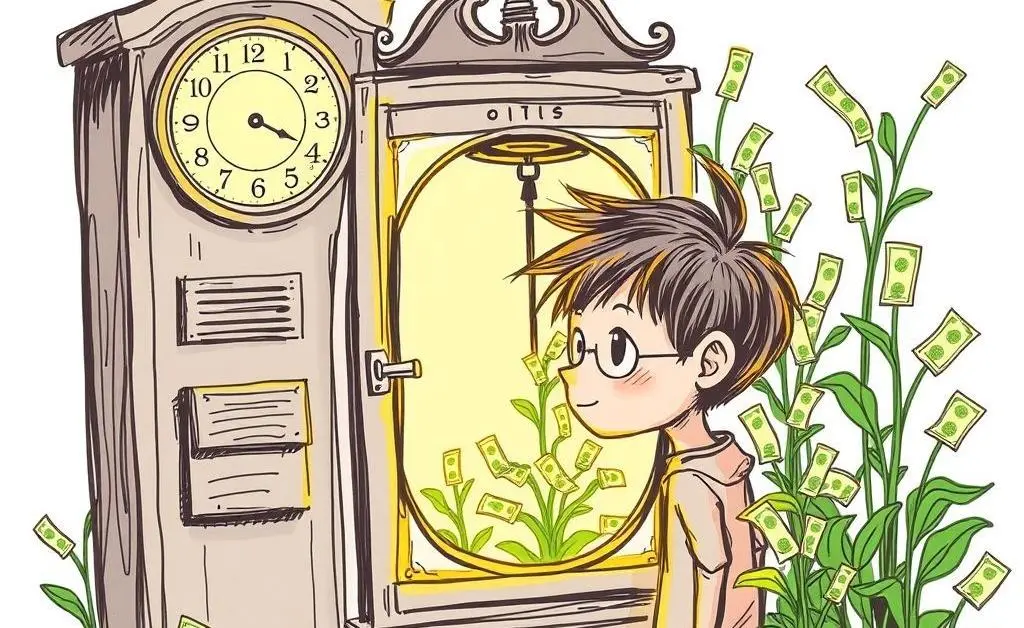

The Magic of Compounding Returns

One of the key reasons long-term investments are so powerful is the magic of compounding. Compounding is like a snowball rolling down a hill, it accumulates more and more snow (or returns, in this case) as it goes.

- Invest regularly, as compounding is more effective the earlier and more consistent you start.

- Reinvest any earnings, letting your money snowball over the years.

- Be patient and let time do its magic.

The Importance of a Diverse Portfolio

Diversifying your investments minimizes risks. It's like not putting all your eggs in one basket. A healthy mix of stocks, bonds, and other assets helps stabilize your returns over time, cushioning you against market volatility.

Staying Calm During Market Fluctuations

Markets inevitably face ups and downs. But remember, short-term drops are often mere blips in the context of decades-long investment journeys.

So next time you see a dip, just think of it as a minor weather change in your long-term investment climate. Staying calm and not reacting impulsively to temporary downturns can keep your financial goals on track.

Where to Start Your Investment Journey

Want to start investing but don't know where to begin? Consider consulting with a financial advisor or exploring beginner-friendly platforms. There's a wealth of resources to guide you as you start your investment journey.

So, what do you think? Are you ready to take the plunge into long-term investing? Share your thoughts on why you're motivated to invest for the future!