Why Personal Finance Feels Like a Game and How You Can Win

Explore why personal finance feels like a game and strategies to win it.

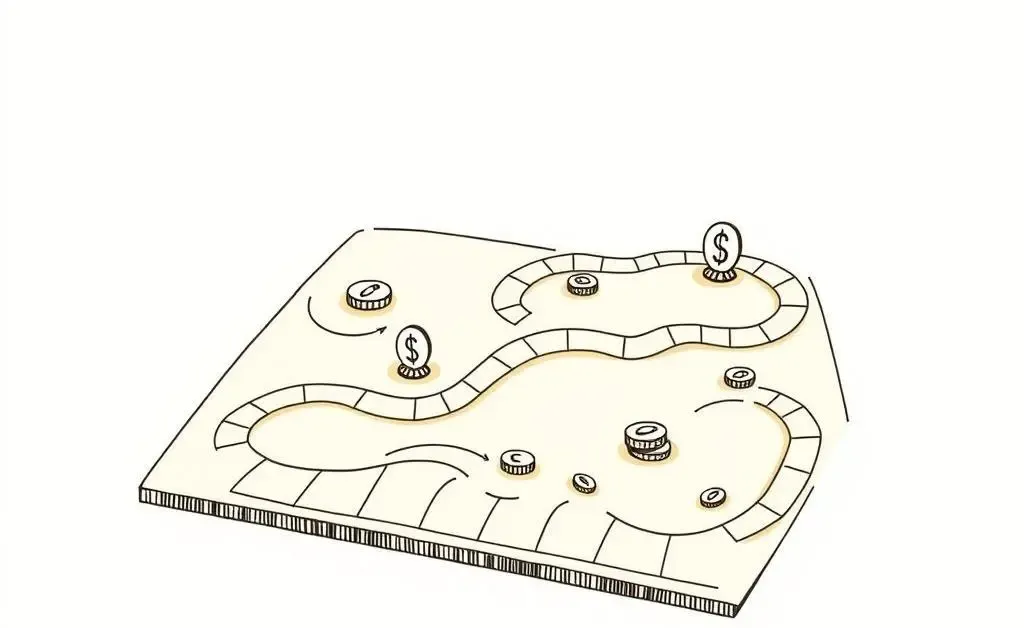

Have you ever noticed how personal finance often feels like playing a board game? Every decision, from where to save your money to how you invest it, feels like a strategic move. But unlike a casual game night, the stakes in this game are pretty real. Whether you're fresh out of college or inching towards retirement, understanding and mastering the ins and outs of personal finance can feel both exhilarating and overwhelming.

What Makes Personal Finance Like a Game?

The idea of turning personal finance into a game may sound odd, but it can be hugely beneficial. Just like in a game, you have a set of rules, tools, and objectives in finance. Your salary and expenditures are your resources, your budget is the game board, and financial strategies are your dice. You win not by beating the competition, but by achieving your personal financial goals.

Setting Clear Goals

Every game has an end goal, whether it’s building an empire or collecting the most tokens. Similarly, personal finance requires clear, actionable goals. Are you aiming to buy a house, save for your children's education, or retire early? Whatever your target, it’s crucial to decide what 'winning' means to you.

Using the Right Tools

Just as a gamer needs the right tools to level up, a smart investor uses budgeting apps, savings accounts, and investment platforms to climb the financial ladder. Explore these budgeting tools that can help keep your finances on track.

Strategies to Master the Game

Be Strategic with Savings and Investments

Strategize your savings and investments to maximize returns. Diversifying your portfolio, understanding risk tolerance, and keeping an emergency fund are just a few tactics seasoned players deploy. Learn more about beginner investment strategies to start building your path to victory.

Stay Flexible and Adapt

Every game has its unpredictable turns, and personal finance is no different. Be prepared to adjust your strategies as life's circumstances change. Keeping a flexible plan can help you navigate unforeseen expenses or changes in income.

The Joy of Winning Your Own Game

The key takeaway in treating personal finance like a game is finding joy and satisfaction in meeting your milestones. It’s less about earning the most money and more about reaching the goals that matter to you personally. As you master your financial game, consider this: What small, strategic changes can you make today to propel you toward your ultimate victory?

Share your thoughts below—what financial game piece are you playing with today?