Why the Timing of Investment Returns Matters More Than You Think

Discover why investment timing is crucial and learn practical steps to make your returns work for you.

Have you ever wondered why some people say timing is everything, especially when it comes to investing? Well, it turns out they're onto something. The timing of your investment returns can dramatically impact your overall wealth. Let me break it down for you in everyday terms.

Timing Isn't Just For Comedians

Picture this: You're planning a weekend trip to the beach. You've packed your sunscreen, but alas, it rains cats and dogs the entire weekend. Just as the weather greatly affects your beach plans, the timing of your investment returns can greatly impact your financial future. An early run of good returns can supercharge your portfolio, whereas a bad start can be like that relentless rain dampening your spirits.

Why Timing Matters More Than You Think

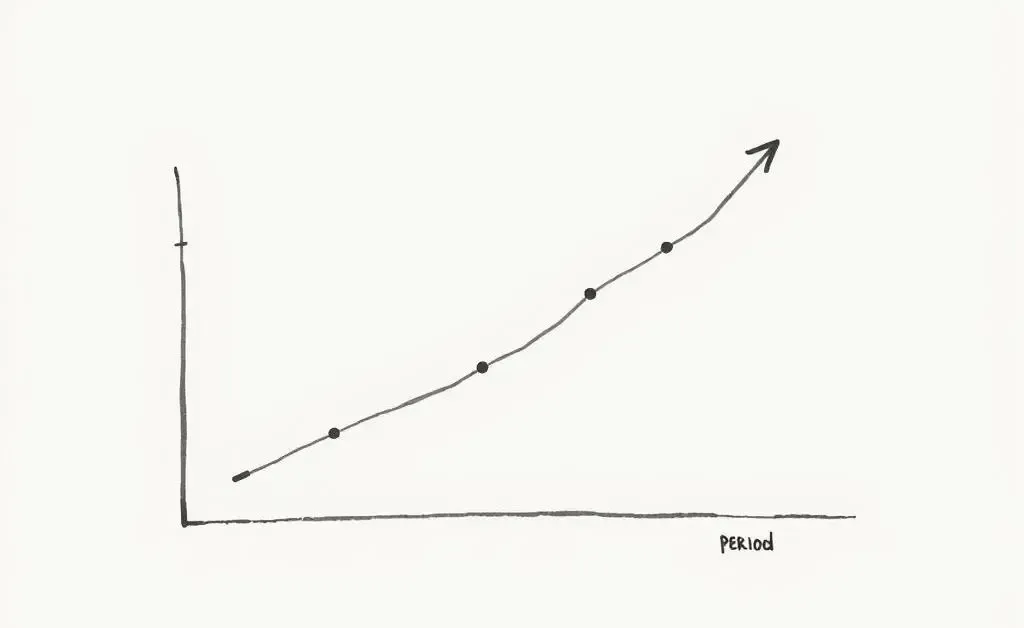

Let's say you've invested $10,000. If your investments do well initially, thanks to the magic of compound interest, you'll likely amass more by retirement than if the market flounders early on. Here's a quick list of why this matters:

- Compounding Interest: Early returns mean more time for your money to grow exponentially.

- Reduced Risk Over Time: Starting strong allows for a buffer against later declines.

- Peace of Mind: Knowing your investments are on the right track reduces financial stress.

Consider this fictional anecdote. Meet Sarah. Sarah started investing in her 20s, right before a market bull run. Her friend Mike, who waited until his 30s, missed those crucial early years of growth, resulting in markedly different financial comfort levels upon retirement, despite investing similar amounts.

Strategies for Navigating the Timing Trap

So, how does one manage the risk of timing? Here are a few strategies to consider:

Diversify Your Investments

You might've heard this one a million times, but it bears repeating. Spreading your investments across different sectors can buffer against market volatility. Think of it as not putting all your eggs in one basket — a simple yet effective strategy.

Stay the Course

When you see market fluctuations, remember the ocean tides. They're natural and nothing to fear. Sticking to your investment strategy during highs and lows can prevent costly mistakes. Consistency, not panic, is your best friend.

Consider Dollar-Cost Averaging

This strategy involves investing a fixed amount of money at regular intervals, regardless of the market's behavior. Over time, you buy more shares when prices are low and fewer when they're high, potentially lowering your average cost per share.

The Takeaway

In the world of investing, timing can be as critical as your chosen investment strategy. While we can't control market trends, we can manage our approach and mindset. Whether you're staring at a rainy beach or a volatile market, it's about making informed decisions and sticking to your plan. So, how do you navigate the uncertainty of investment returns? Share your thoughts in the comments — I’d love to hear your story!