Why Understanding Your UTMA Account Rights is Essential: A Personal Finance Story

Discover what to know about UTMA accounts to protect your financial future. Learn from personal experiences and ensure transparency.

The Shock of a Closed Account

Imagine waking up one day to discover your UTMA account has been closed without your knowledge. This scenario, while unsettling, is not unheard of for many young adults transitioning into financial independence. It’s a wake-up call on the importance of being informed about your rights and responsibilities regarding custodial accounts, and it underscores a critical gap in financial literacy many experience today.

What is a UTMA Account?

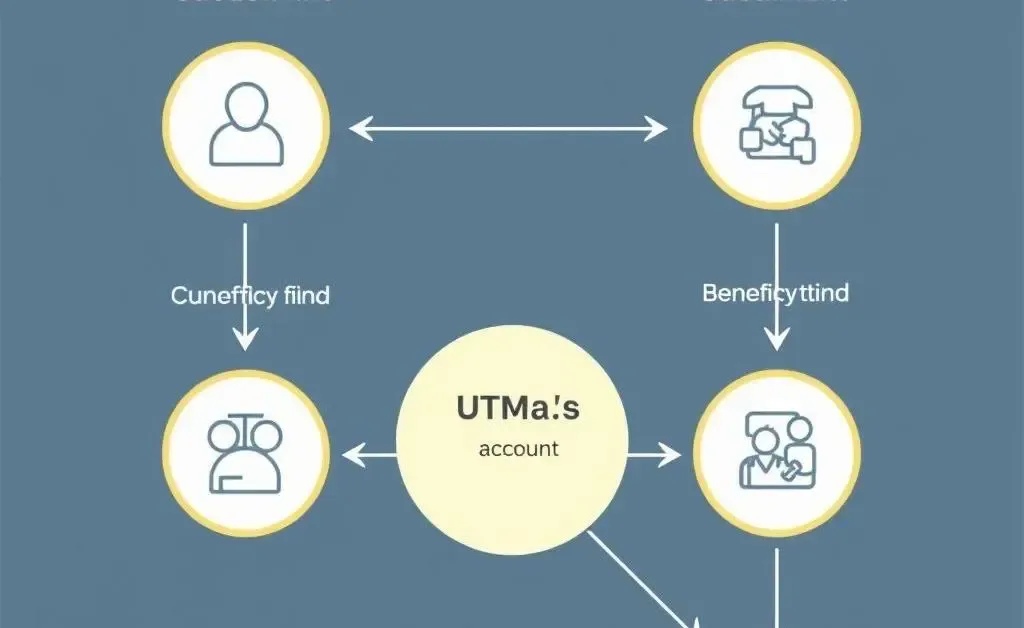

The first question you might have is, “What is a UTMA account?” Simply put, a Uniform Transfers to Minors Act (UTMA) account is a type of custodial account that allows minors to receive gifts or transfers without needing a trust or guardian involved. These accounts are held by an adult custodian until the minor reaches the age of majority, which varies by state.

Why UTMA Accounts Are Useful

UTMA accounts are a great way to transfer assets to minors without establishing a complex trust. Parents often use these accounts to save for their children’s education or other future needs while enjoying tax benefits. However, they require a careful understanding of who controls the funds and when.

The Rug Pull: What Can Go Wrong

There are stories, like a friend's, where parents, acting as custodians, closed the UTMA account or used funds for unintended purposes, leaving the minor in the dark. This highlights the importance of clear communication and understanding between the custodian and the beneficiary. If you're the beneficiary, ensuring transparency about your UTMA account—its balance, intended use, and access permissions—is crucial.

Steps to Protect Yourself

- Educate Yourself: Learn about the specific regulations in your state and the age at which you gain control of the account.

- Keep Communication Open: Regularly discuss the account’s purpose and status with the custodian.

- Document Everything: Keep records of all communications and statements related to the account for transparency.

- Seek Advice: If needed, consult with a financial advisor to understand your rights and plan effectively.

Moving Forward with Confidence

Taking an active role in understanding your UTMA account is empowering. It’s not just about demanding transparency but also taking responsibility for your future. The knowledge and experience you gain can become the cornerstone of your financial literacy foundation.

Have any of you had experiences with UTMA accounts you'd like to share? I'm curious to hear how others have navigated these waters, and I bet there's so much we can all learn from one another.