Why Your Car Insurance Costs So Much: A Friendly Breakdown

Explore why car insurance seems steep and discover practical ways to save.

Have you ever opened your car insurance bill and wondered why it seemed so high? You're not alone. Having recently faced a more expensive renewal myself, I was determined to dive deep and uncover the reasons behind these steep prices.

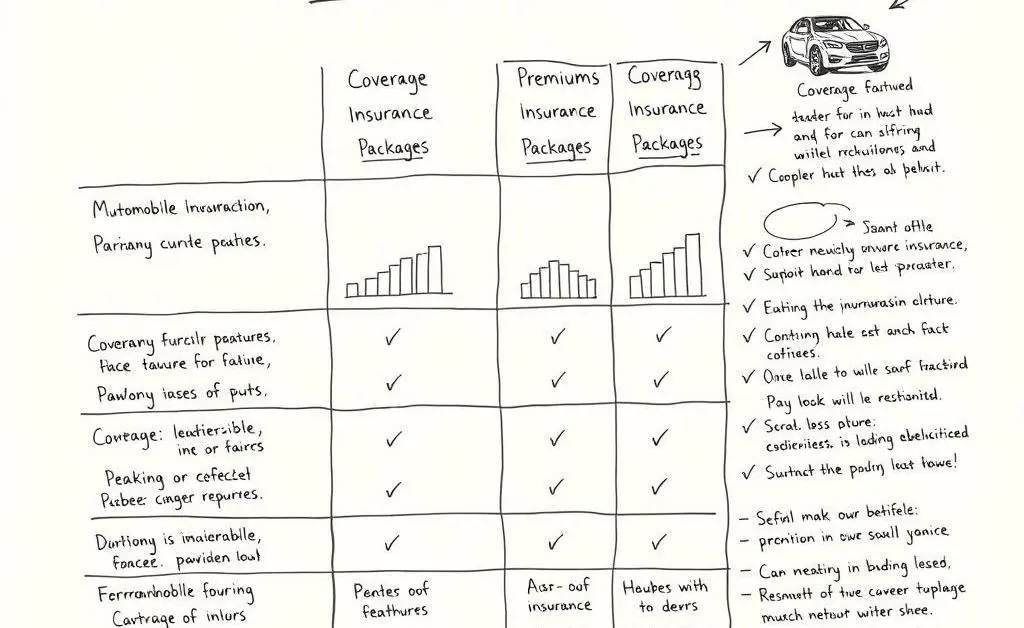

What Factors Influence Car Insurance Costs?

Understanding what drives those numbers up is the first step to controlling them. Here are some key factors:

- Driving Record: Accidents and violations vividly reflect in insurance costs.

- Vehicle Type: Sports cars might look appealing, but they tend to attract higher premiums.

- Location: Where you park your car overnight plays a surprising role in determining your rates.

- Credit Score: Some insurers use credit scores to gauge risk and determine rates.

- Coverage Limits: Higher coverage offers more protection but drives up the cost.

An Anecdote: My Recent Renewal Surprise

Just last month, I opened my revised policy from my insurer, expecting a modest increase. Instead, the new bill made my heart skip a beat. Surprised, I dug into the details and found that an accident from over two years ago was still impacting my rates. This experience reminded me just how important it is to review renewal documents thoroughly.

Practical Ways to Reduce Your Car Insurance Premium

Determined to bring that cost down? Here are some strategies I've tried and found effective:

- Shop around for better prices; loyalty sometimes doesn't pay.

- Consider a higher deductible to reduce monthly premiums.

- Bundle with other policies for a multi-policy discount.

- Maintain a clean driving record and monitor your usage.

Staying Proactive

The conversation about car insurance is ongoing, with constant changes in policies and rates. Keep assessing your needs and monitoring changes in policies so you don't get blindsided by unexpected hikes. Have you discovered any unique ways to save on your insurance that others might benefit from?