Your Complete Guide to Navigating Car Insurance

Discover practical tips to find the best car insurance tailored to you.

Hey there! If you've ever felt like finding the right car insurance is as confusing as assembling IKEA furniture without instructions, you're definitely not alone. That's why I'm here to help guide you through some useful tips to navigate the world of car insurance, making it less daunting and hopefully saving you a few bucks along the way.

Understanding Your Car Insurance Needs

Before diving headfirst into searching for car insurance, it's crucial to understand your personal needs. Are you a new driver? Do you have a spotless driving record? These factors, along with others like your car model and mileage, play a big role in determining the type of coverage you should be aiming for.

Key Factors to Consider

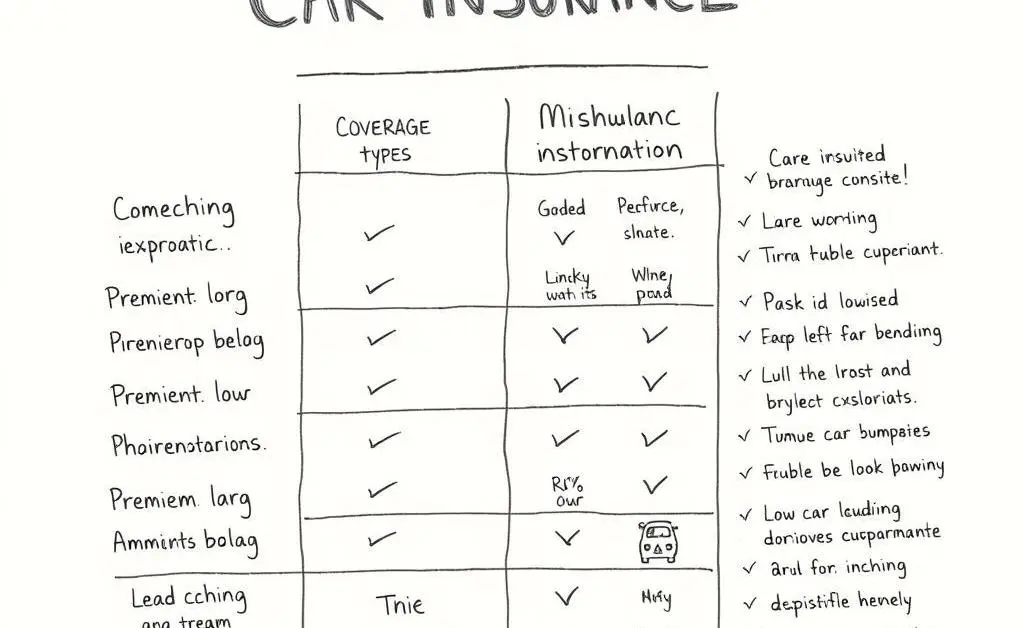

- Type of coverage needed (liability, comprehensive, collision)

- Your driving history and experience

- Vehicle type and usage

- Your budget

Shopping for the Best Car Insurance

Once you've got a grip on your needs, it's time to shop around. I can't stress enough how important it is to get multiple quotes from various insurers. This might seem like a chore, but trust me, the time spent here could result in significant savings.

How to Get Quotes

Most insurance companies offer free quotes on their websites. Consider using comparison websites where you can see different offers side-by-side. Don't shy away from picking up the phone and talking to an agent directly — they often provide insights and can sometimes offer unseen discounts.

Discounts and Bundles: Your Best Friends

Who doesn't love a good discount? From bundling your home and auto insurance to safe driver discounts, there's a plethora of ways to cut your insurance costs down. Make sure to ask about available discounts when getting quotes.

Common Discounts

- Multi-policy discount

- Good driver discount

- Reduced mileage discount

- Good student discount

Reading the Fine Print

The devil is in the details, they say, and this couldn't be more accurate with insurance policies. Be sure to read through the terms and conditions of your chosen policy. Understand what is covered and what isn't to avoid any surprises when you need to file a claim.

Review and Re-evaluate Annually

Finally, remember that car insurance isn't a 'set it and forget it' product. Review your policy annually or whenever significant changes happen in your life, like buying a new car or moving to a new location. This ensures you always have the best deal available.

Hopefully, this guide makes the journey of finding car insurance a bit smoother. What's your biggest challenge when shopping for car insurance? Let me know in the comments!