Your Friendly Guide to Navigating Life Insurance Decisions

Find out how to choose the right life insurance with confidence. A warm, insightful guide.

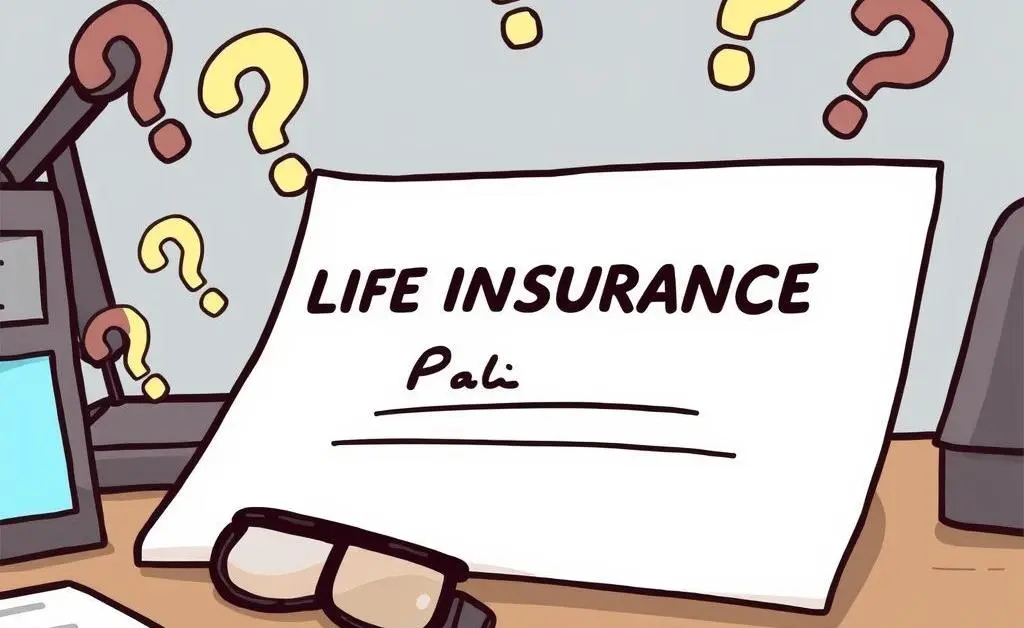

Have you ever tried to decipher the mystery that is life insurance, only to feel like you need a secret decoder ring? You're not alone! Many people wonder how to select the right life insurance policy without being overwhelmed by fine print and jargon. Let's dive into this topic with our primary keyword, 'life insurance,' breaking it down into bite-sized pieces that make sense for your life and goals.

Why Consider Life Insurance?

First and foremost, life insurance provides a financial safety net for your loved ones. In an unpredictable world, having a policy in place can ease the tension and provide peace of mind that your family is protected from unforeseen expenses. It also supports long-term planning, helping you meet future family goals, like funding college education or paying off a mortgage.

Common Questions About Life Insurance

Many people feel uncertain and want straightforward answers. Here are a few questions that surface frequently:

- How much coverage do I need?

- What kind of policy is best: term or whole life?

- How does life insurance fit into my budget?

No absolute answers, but guidance can make a difference. Imagine Jane, a mother of two, who struggles to decide between a term life policy and whole life insurance. She isn't sure which benefits her family's future the most.

Navigating Life Insurance Types

Term Life Insurance: Think of this as 'lease life insurance.' It offers coverage for a specific period and is often less costly upfront. Ideal if you have short-term debts or young children.

Whole Life Insurance: This is 'forever life insurance.' It usually costs more but includes an investment component, building cash value over time. Good for long-term financial strategies.

Planning Within Your Budget

Determining how life insurance fits into your financial picture is crucial. Start with these steps:

Assess Your Needs: Calculate current debt, income replacement needs, and future obligations.

Review Your Budget: Create a simple planner and find out what premium amount is sustainable.

Shop Smart: Compare different policies and insurers. Resources like NerdWallet's insurance guide can be handy.

Reaching Future Goals

With life insurance, you're not just buying peace of mind; you're investing in your family's future. It's a proactive step toward financial stability, ensuring that your goals remain within reach, even in your absence.

Embrace this protection as a partnership in securing your family's happiness and success.

Your Turn to Share

Now, let's chat! What's your biggest question or concern about buying life insurance? Leave a comment, and let's start a conversation with other curious minds who are just as eager to learn about life insurance as you are!